August U.S. inflation rises 0.1% month-over-month, causing the annual rate to ease to 8.3%, from 8.5% in July.

After the CPI reports, U.S. Treasury yields continued speculation that the Fed will stick to its aggressive hiking plans and keep monetary policy restrictive for longer than expected or at least until inflation shows compelling signs of easing.

The move in bond rates caused the U.S Dollar (DXY) to rally as traders bet yield differentials will continue to be a headwind in the future.

Financial conditions might start tightening again after easing in recent days in the wake of the huge stock market rally. This situation will fuel volatility, creating a negative bias for U.S. equities.

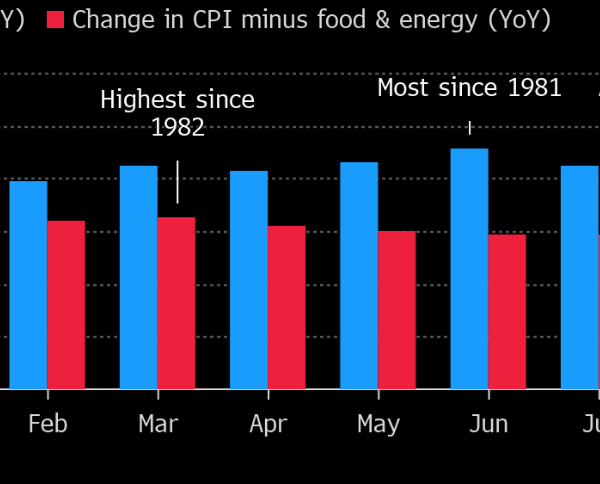

Inflationary pressures in the United States did not cool, showing that the Federal Reserve has more work to do to restore price stability and bring lasting relief to U.S. households, whose budgets have been squeezed by the cost-of-living spike that has taken place for much of the first half of the year.