The DXY index has recently been rising and gaining as a result of its near parity state to the Euro has started to decline. The Euro’s offshoot largely drives this decline. Since EUR accounts for about 57% of the DXY’s weight, the index will definitely react in an almost contrary manner.

While this change in the EUR/USD trend may be temporary, we may experience a period of horizontal price action increase before the broader trends try to revalidate themselves. This move does not look like a permanent reversal; that would take some getting used to. Given the fact that it is yet a 3days thing, experts believe it is temporary.

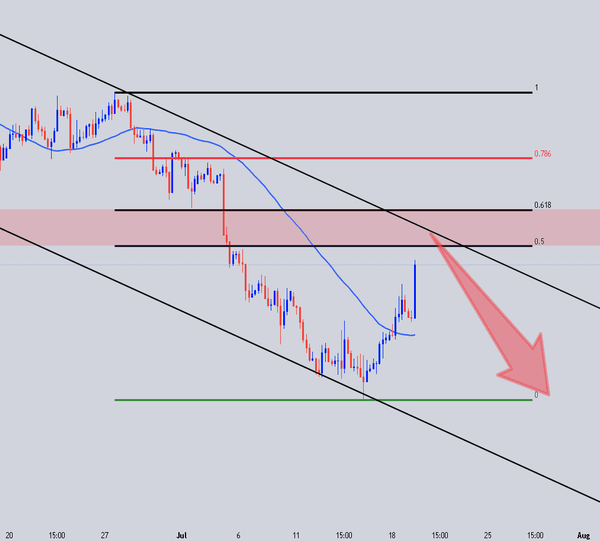

There have been several temporary trends in times past. You can observe the DXY, EUR/USD 10581 and 10340 trends. The DXY support level is solid, with the June high and a trend from May falling at the same price point.

Furthermore, the EUR/USD in 2017 fell low at 10340, which is just a fraction lower than a pair of lows that developed in May and June. Although, these trends are not a determinant of the current EUR/USD rebound and decline, respectively. It is merely a pointer that the dynamics might be short-lived.