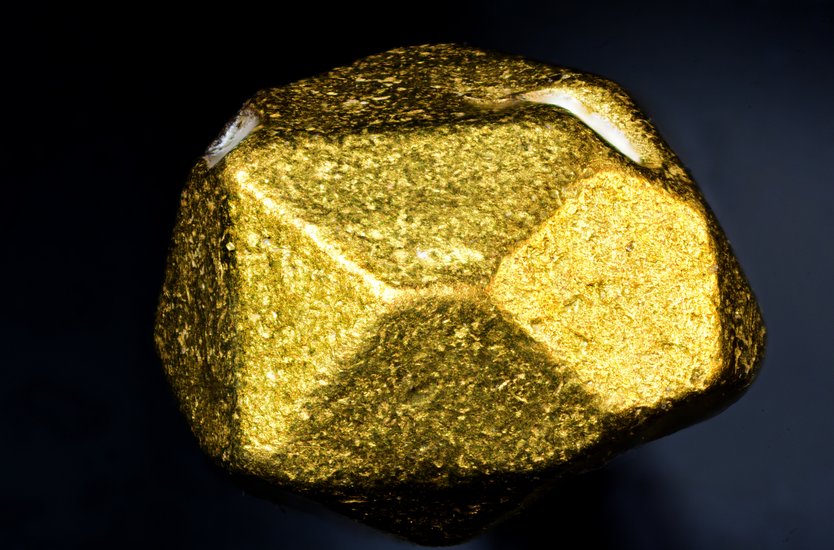

Recently, gold rebounded to the joy of dealers. However, it has failed to extend its highs from this past week and seems to be stagnant. Furthermore, the Fed decision might enhance the stalling in its rebound as the Central bank appears prepared to implement a restrictive policy. Therefore, gold’s price may keep consolidating ahead of the Federal Open Market Committee (FOMC).

The Central bank is expected to deliver a 75bp rate hike, and the increase from the yearly low may be a one-time thing as the SMA continues to reflect a negative slope. This might cause gold to face blows for the rest of the year since the FOMC plans to set the Fed Funds rate above neutral.

Also, the market wonders whether Chairman Jerome Powell and his team will intensify their efforts to restrain the US Consumer Price Index (CPI) rise as the central bank plans to enhance a soft landing for the economy.

As a result, gold may trade at low prices if the FOMC implements the restrictive policy. At the same time, a shift in Fed’s forward guidance may promote a relevant recovery in the price of gold.

This Post Has 1,213 Comments

CorPharmacy: CorPharmacy – online pharmacy uk

CorPharmacy Cor Pharmacy reputable indian pharmacies

canadian pharmacy without prescription http://viagranewark.com/# Generic Viagra for sale

erectile dysfunction pills online: ed medicine online – Ed Pills Afib

pharmacy rx world canada: CorPharmacy – CorPharmacy

online ed treatments cheap ed pills online ed treatment online

online canadian pharcharmy http://viagranewark.com/# ViagraNewark

https://edpillsafib.com/# ed online meds

Viagra Newark: ViagraNewark – Viagra Newark

ViagraNewark cheap viagra ViagraNewark

CorPharmacy: CorPharmacy – CorPharmacy

http://corpharmacy.com/# rx pharmacy online 24

Cor Pharmacy: canadian pharmacy meds review – CorPharmacy

CorPharmacy CorPharmacy canada pharmacy world

Cor Pharmacy: CorPharmacy – CorPharmacy

https://corpharmacy.xyz/# best european online pharmacy

Cor Pharmacy: Cor Pharmacy – CorPharmacy

canadian pharmaceuticals online safe https://viagranewark.xyz/# Viagra without a doctor prescription Canada

Viagra Newark: ViagraNewark – Viagra Newark

Kamagra 100mg price: Kamagra tablets – Kamagra 100mg price

DmuCialis: Dmu Cialis – Cialis over the counter

https://neokamagra.com/# Neo Kamagra

canadapharmacyonline.com http://dmucialis.com/# DmuCialis

NeoKamagra: NeoKamagra – Neo Kamagra

DmuCialis: Dmu Cialis – Dmu Cialis

reputable online canadian pharmacy https://dmucialis.xyz/# DmuCialis

MuscPharm: MuscPharm – canadian mail order drugs

NeoKamagra: Neo Kamagra – Neo Kamagra

buy online prescription drugs http://neokamagra.com/# Kamagra Oral Jelly

http://muscpharm.com/# legit canadian pharmacy online

DmuCialis: Dmu Cialis – DmuCialis

Neo Kamagra: NeoKamagra – Kamagra 100mg

best online international pharmacies https://neokamagra.xyz/# buy Kamagra

reputable online pharmacy: MuscPharm – online pharmacies canadian

most trusted canadian online pharmacy https://dmucialis.xyz/# buy cialis pill

Musc Pharm: MuscPharm – Musc Pharm

Dmu Cialis DmuCialis DmuCialis

http://dmucialis.com/# DmuCialis

top rated canadian online pharmacy https://muscpharm.xyz/# Musc Pharm

canadian pharmacy online no prescription needed: MuscPharm – buy mexican drugs online

online discount pharmacy https://dmucialis.com/# Generic Cialis price

Dmu Cialis: DmuCialis – Tadalafil price

online canadian pharmacy no prescription needed https://neokamagra.com/# Neo Kamagra

NeoKamagra NeoKamagra NeoKamagra

https://neokamagra.com/# NeoKamagra

synthroid canadian pharmacy https://muscpharm.com/# Musc Pharm

DmuCialis: Dmu Cialis – Dmu Cialis

MuscPharm Musc Pharm MuscPharm

canadian pharmacy world https://neokamagra.xyz/# NeoKamagra

Kamagra 100mg price: NeoKamagra – NeoKamagra

Dmu Cialis: Dmu Cialis – Cheap Cialis

Musc Pharm overseas online pharmacy MuscPharm

http://dmucialis.com/# Cialis 20mg price in USA

canada pharmacy reviews https://neokamagra.xyz/# Neo Kamagra

Buy Tadalafil 10mg: Dmu Cialis – Dmu Cialis

MuscPharm MuscPharm canadian drugstore viagra

NeoKamagra: NeoKamagra – Neo Kamagra

top mail order pharmacies in usa https://muscpharm.com/# Musc Pharm

Musc Pharm MuscPharm MuscPharm

cheap kamagra: Kamagra tablets – NeoKamagra

buy abortion pills: Misoprostol 200 mg buy online – order cytotec online

Socal Abortion Pill Socal Abortion Pill Socal Abortion Pill

buy generic propecia pill: BswFinasteride – BswFinasteride

online shopping pharmacy india http://cytpremium.com/# buy abortion pills

UclaMetformin: metformin order canada – UclaMetformin

SocalAbortionPill: buy cytotec over the counter – purchase cytotec

generic propecia no prescription: BSW Finasteride – BswFinasteride

world pharmacy india http://uclametformin.com/# where to buy metformin in usa

UclaMetformin: UclaMetformin – metformin 500 mg er

world pharmacy india https://pmaivermectin.com/# PmaIvermectin

SocalAbortionPill: buy abortion pills – SocalAbortionPill

Socal Abortion Pill: Socal Abortion Pill – Socal Abortion Pill

indian pharmacy paypal http://socalabortionpill.com/# Socal Abortion Pill

metformin where to get: Ucla Metformin – Ucla Metformin

PmaIvermectin: PMA Ivermectin – PMA Ivermectin

top 10 online pharmacy in india https://pmaivermectin.xyz/# ivermectin scabies buy online

UclaMetformin: Ucla Metformin – metformin on line

buy cytotec pills: Socal Abortion Pill – buy abortion pills

Online medicine order https://uclametformin.xyz/# UclaMetformin

SocalAbortionPill SocalAbortionPill buy abortion pills

UclaMetformin: Ucla Metformin – Ucla Metformin

BswFinasteride: BswFinasteride – BSW Finasteride

real canadian pharmacy http://mhfapharm.com/# MhfaPharm

Uva Pharm: UvaPharm – Uva Pharm

https://isoindiapharm.xyz/# reputable indian online pharmacy

canadian pharmacy 365 https://mhfapharm.xyz/# MhfaPharm

MHFA Pharm: canadianpharmacymeds com – MHFA Pharm

http://uvapharm.com/# Uva Pharm

canadian pharmacy price checker https://mhfapharm.xyz/# MHFA Pharm

northern pharmacy canada: MhfaPharm – canadian pharmacy meds reviews

http://uvapharm.com/# UvaPharm

pet meds without vet prescription canada https://mhfapharm.com/# MHFA Pharm

MhfaPharm canadian pharmacy no scripts MhfaPharm

Iso Pharm: IsoIndiaPharm – Iso Pharm

global pharmacy canada http://mhfapharm.com/# MHFA Pharm

https://uvapharm.com/# UvaPharm

best canadian online pharmacy reviews https://isoindiapharm.xyz/# Iso Pharm

canadian pharmacy price checker: MHFA Pharm – canadian pharmacy store

http://mhfapharm.com/# MhfaPharm

MHFA Pharm MhfaPharm MHFA Pharm

IsoIndiaPharm: buy prescription drugs from india – Iso Pharm

canada pharmacy online https://isoindiapharm.com/# reputable indian pharmacies

Iso Pharm: Iso Pharm – IsoIndiaPharm

canadian pharmacy in canada https://mhfapharm.com/# best mail order pharmacy canada

http://isoindiapharm.com/# IsoIndiaPharm

IsoIndiaPharm: Iso Pharm – Iso Pharm

online canadian pharmacy review https://mhfapharm.xyz/# MHFA Pharm

IsoIndiaPharm top online pharmacy india Iso Pharm

cheapest online pharmacy india: buy prescription drugs from india – indian pharmacy

https://uvapharm.com/# UvaPharm

pharmacy canadian https://uvapharm.com/# mexico meds

Uva Pharm: mexican pharmacys – UvaPharm

safe online pharmacies in canada: MHFA Pharm – MhfaPharm

MHFA Pharm MhfaPharm canadian pharmacy cheap

reliable canadian pharmacy reviews http://uvapharm.com/# mexico meds

IsoIndiaPharm: Online medicine home delivery – IsoIndiaPharm

https://mhfapharm.xyz/# MhfaPharm

https://bluewavemeds.xyz/# Blue Wave Meds

EveraMeds EveraMeds Cialis over the counter

EveraMeds: Buy Tadalafil 5mg – EveraMeds

https://everameds.xyz/# Buy Cialis online

EveraMeds EveraMeds EveraMeds

Cheap Cialis: buy cialis pill – EveraMeds

http://everameds.com/# buy cialis pill

EveraMeds Buy Tadalafil 10mg Tadalafil Tablet

AeroMedsRx: Cheap Sildenafil 100mg – order viagra

http://bluewavemeds.com/# buy Kamagra online

buy Kamagra online: order Kamagra discreetly – Blue Wave Meds

Generic Viagra online AeroMedsRx Viagra without a doctor prescription Canada

Tadalafil Tablet: EveraMeds – Cialis without a doctor prescription

https://aeromedsrx.com/# sildenafil over the counter

best price for viagra 100mg Viagra without a doctor prescription Canada over the counter sildenafil

Viagra online price: Sildenafil 100mg price – Cheap Sildenafil 100mg

https://everameds.xyz/# EveraMeds

Cheap Cialis: Tadalafil Tablet – Cheap Cialis

https://aeromedsrx.xyz/# AeroMedsRx

AeroMedsRx: AeroMedsRx – Cheap Sildenafil 100mg

buy Kamagra online Blue Wave Meds trusted Kamagra supplier in the US

https://bluewavemeds.xyz/# order Kamagra discreetly

cialis generic: Cialis without a doctor prescription – EveraMeds

Generic Cialis without a doctor prescription EveraMeds Generic Cialis price

https://everameds.com/# EveraMeds

EveraMeds: Cialis without a doctor prescription – EveraMeds

buy Kamagra online: order Kamagra discreetly – Blue Wave Meds

Blue Wave Meds kamagra order Kamagra discreetly

https://aeromedsrx.xyz/# Cheap Viagra 100mg

BlueWaveMeds: BlueWaveMeds – BlueWaveMeds

BlueWaveMeds kamagra BlueWaveMeds

https://everameds.com/# Buy Tadalafil 5mg

kamagra: BlueWaveMeds – online pharmacy for Kamagra

Viagra Tablet price cheap viagra sildenafil over the counter

https://bluewavemeds.com/# online pharmacy for Kamagra

online pharmacy for Kamagra: kamagra – Blue Wave Meds

Cialis 20mg price in USA: Generic Tadalafil 20mg price – Cialis over the counter

trusted Kamagra supplier in the US kamagra online pharmacy for Kamagra

https://bluewavemeds.xyz/# fast delivery Kamagra pills

kamagra: order Kamagra discreetly – fast delivery Kamagra pills

http://aeromedsrx.com/# Cheap Sildenafil 100mg

AeroMedsRx AeroMedsRx AeroMedsRx

EveraMeds: Cialis over the counter – EveraMeds

https://aeromedsrx.xyz/# Viagra without a doctor prescription Canada

Blue Wave Meds fast delivery Kamagra pills kamagra oral jelly

EveraMeds: EveraMeds – Buy Tadalafil 10mg

https://bluewavemeds.xyz/# fast delivery Kamagra pills

http://aeromedsrx.com/# Cheap Sildenafil 100mg

Generic Cialis without a doctor prescription EveraMeds EveraMeds

AeroMedsRx: Cheap generic Viagra online – Cheap generic Viagra online

https://everameds.com/# EveraMeds

EveraMeds EveraMeds EveraMeds

Buy Tadalafil 5mg: EveraMeds – EveraMeds

https://aeromedsrx.com/# cheap viagra

Buy Tadalafil 5mg: EveraMeds – EveraMeds

https://everameds.xyz/# Generic Cialis price

AeroMedsRx Cheap Sildenafil 100mg AeroMedsRx

https://aeromedsrx.xyz/# AeroMedsRx

http://bluewavemeds.com/# buy Kamagra online

buy Viagra over the counter AeroMedsRx AeroMedsRx

AeroMedsRx: Cheap generic Viagra online – buy viagra here

buy Kamagra online buy Kamagra online trusted Kamagra supplier in the US

Cheap Cialis: buy cialis pill – Generic Cialis price

https://aeromedsrx.com/# Sildenafil 100mg price

https://everameds.xyz/# EveraMeds

cialis for sale: Buy Tadalafil 20mg – EveraMeds

viagra without prescription AeroMedsRx AeroMedsRx

http://bluewavemeds.com/# kamagra oral jelly

https://aeromedsrx.com/# AeroMedsRx

BlueWaveMeds: order Kamagra discreetly – kamagra oral jelly

online pharmacy for Kamagra: online pharmacy for Kamagra – fast delivery Kamagra pills

online pharmacy for Kamagra Blue Wave Meds kamagra

https://aeromedsrx.xyz/# AeroMedsRx

http://aeromedsrx.com/# AeroMedsRx

https://navikarapharmacy.com/# cheap amoxil

http://prednexamed.com/# prednisone 200 mg tablets

Navikara Pharmacy: amoxil pharmacy – generic amoxil

Stromectol tablets Stromecta Direct StromectaDirect

amoxacillian without a percription: cheap amoxil – amoxil online

https://stromectadirect.com/# Stromectol buy cheap

http://stromectadirect.com/# Stromectol buy cheap

Navikara Pharmacy: generic amoxil – generic amoxil

ivermectin for covid mayo clinic: ivermectin for cats ear mites – StromectaDirect

http://stromectadirect.com/# best pharmacy buy Stromectol

http://indiavameds.com/# indian pharmacy

buy ivermectin online: Stromectol over the counter – Stromectol buy cheap

IndiavaMeds Indiava Meds online medicine

https://indiavameds.com/# meds from india

Prednexa Med: prednisone over the counter south africa – prednisone price

https://indiavameds.com/# online medicine

Indiava Meds: india rx – indian pharmacy

online drugs: IndiavaMeds – online meds

https://stromectadirect.com/# Stromectol over the counter

buy prednisone buy prednisone prednisone price

https://navikarapharmacy.com/# buy amoxil

Stromectol tablets: buy ivermectin online – buy ivermectin online

Stromectol tablets: ivermectin heartworms – buy ivermectin online

Indiava Meds: medicines online – india pharmacy

amoxicillin 500 mg for sale: buy amoxil – Amoxicillin 500mg buy online

india pharmacy: indian pharmacy – Indiava Meds

Indiava Meds: indian pharmacy – IndiavaMeds

PrednexaMed: prednisone 40 mg price – 1 mg prednisone daily

prednisone price: buy prednisone – PrednexaMed

buy prednisone 10mg online Prednexa Med PrednexaMed

http://indiavameds.com/# india pharmacy

Prednexa Med: PrednexaMed – prednisone 20 mg generic

Navikara Pharmacy: Amoxicillin 500mg buy online – generic amoxil

Amoxicillin 500mg buy online: Navikara Pharmacy – amoxil online

https://stromectadirect.xyz/# Stromectol buy cheap

buy amoxil: Navikara Pharmacy – Navikara Pharmacy

prednisone price prednisone price prednisone 30 mg daily

indian pharmacy: Indiava Meds – IndiavaMeds

prednisone price: buy prednisone – Prednexa Med

https://navikarapharmacy.com/# amoxil online

Doctor North Rx: verified Canada drugstores – Doctor North Rx

doctor recommended Canadian pharmacy: verified Canada drugstores – Doctor North Rx

Dr India Meds indian pharmacy safe Indian generics for US patients

medications from india verified Indian drugstores no prescription pharmacy India

verified Indian drugstores: indian pharmacy – verified Indian drugstores

best online pharmacies Canada to USA: safe Canadian pharmacies for Americans – canadian pharmacy online

DoctorNorthRx canadian pharmacy best online pharmacies Canada to USA

mexico pet pharmacy: doctor recommended Mexican pharmacy – trusted Mexican drugstores online

pharmacy online: Mexico to USA pharmacy shipping – doctor recommended Mexican pharmacy

mexican pharmacy online verified Mexican pharmacies USA delivery verified Mexican pharmacies USA delivery

best online pharmacies Canada to USA best online pharmacies Canada to USA safe Canadian pharmacies for Americans

Dr Meds Advisor: doctor recommended Mexican pharmacy – generic medicine from Mexico

mexico pharmacy: safe medications from Mexico – trusted Mexican drugstores online

verified Canada drugstores canadian pharmacy affordable medications from Canada

canadian pharmacy online: DoctorNorthRx – affordable medications from Canada

safe medications from Mexico mexican pharmacy mexicanrxpharm

safe Canadian pharmacies for Americans canadian pharmacy online Doctor North Rx

DrIndiaMeds: affordable Indian medications online – indian pharmacy

onlinepharmaciescanada com: best online canadian pharmacy – canadian pharmacy

https://drmedsadvisor.com/# Mexico to USA pharmacy shipping

indian pharmacies: doctor recommended Indian pharmacy – trusted medical sources from India

safe Canadian pharmacies for Americans: legitimate pharmacy shipping to USA – affordable medications from Canada

https://drindiameds.com/# affordable Indian medications online

DoctorNorthRx safe Canadian pharmacies for Americans doctor recommended Canadian pharmacy

affordable medications from Canada: legitimate pharmacy shipping to USA – doctor recommended Canadian pharmacy

https://drindiameds.com/# indian pharmacy

affordable medications from Canada best online pharmacies Canada to USA canadian pharmacy

verified Indian drugstores: india pharmacy – no prescription pharmacy India

https://doctornorthrx.com/# legitimate pharmacy shipping to USA

trusted Canadian generics affordable medications from Canada trusted Canadian generics

pharmacy online order: Indian pharmacy coupon codes – affordable Indian medications online

affordable Indian medications online: affordable Indian medications online – doctor recommended Indian pharmacy

http://doctornorthrx.com/# safe Canadian pharmacies for Americans

Dr Meds Advisor safe medications from Mexico generic medicine from Mexico

india pharmacy: indian pharmacy – trusted medical sources from India

https://drindiameds.com/# online medicine sites

verified Indian drugstores affordable Indian medications online Indian pharmacy coupon codes

trusted Mexican drugstores online: mexico pharmacy – generic medicine from Mexico

Doctor North Rx best online pharmacies Canada to USA best online pharmacies Canada to USA

Dr India Meds: trusted medical sources from India – affordable Indian medications online

https://drmedsadvisor.xyz/# DrMedsAdvisor

verified Mexican pharmacies USA delivery safe medications from Mexico Dr Meds Advisor

generic medicine from Mexico: verified Mexican pharmacies USA delivery – Dr Meds Advisor

safe medications from Mexico: certified Mexican pharmacy discounts – DrMedsAdvisor

https://drmedsadvisor.xyz/# mexican pharmacy

safe Indian generics for US patients trusted medical sources from India doctor recommended Indian pharmacy

apotek online sverige: Basta natapotek 2025 – Basta natapotek 2025

Rabatt Apotek: Rabatterte generiske medisiner – Rabatterte generiske medisiner

Medicijnen zonder recept bestellen Medicijnen zonder recept bestellen KortingApotheek

https://mexmedsreview.xyz/# save on prescription drugs from Mexico

https://kortingapotheek.xyz/# online apotheek nederland

Hvilket apotek på nett er best i Norge: apotek på nett – Rabatt Apotek

Kunder rankar bästa apotek online apoteket rabattkod Kunder rankar bästa apotek online

apotek pa nett: Kundevurderinger av nettapotek – Kundevurderinger av nettapotek

http://tryggapotekguiden.com/# Köp medicin utan recept Sverige

apotek online sverige: Bästa nätapotek 2025 – Rabattkod för apotek på nätet

verified Mexican pharmacy promo codes MexMedsReview MexMedsReview

Kunder rankar basta apotek online: apoteket recept – Kop medicin utan recept Sverige

https://kortingapotheek.com/# online apotheek nederland zonder recept

http://rabattapotek.com/# Billige medisiner uten resept Norge

Rabatt Apotek: Kundevurderinger av nettapotek – Kundevurderinger av nettapotek

KortingApotheek: apotheek online – Korting Apotheek

Mexican pharmacies ranked 2025 verified Mexican pharmacy promo codes discount meds from Mexico online

MexMedsReview: Mex Meds Review – Mex Meds Review

http://rabattapotek.com/# Billige medisiner uten resept Norge

Medicijnen zonder recept bestellen: apotheek online – KortingApotheek

https://tryggapotekguiden.xyz/# Snabb leverans apoteksvaror online

Apotek på nett sammenligning Rabatt Apotek RabattApotek

Kunder rankar basta apotek online: Kop medicin utan recept Sverige – apotek online sverige

Korting Apotheek: Medicijnen zonder recept bestellen – online apotheek nederland zonder recept

https://tryggapotekguiden.com/# apoteket rabattkod

Rabatt Apotek Nettapotek med rask frakt Rabatt Apotek

buy medications from Mexico legally: mexican pharmacy – mexican pharmacy

http://kortingapotheek.com/# online apotheek nederland

https://mexmedsreview.xyz/# MexMedsReview

https://tryggapotekguiden.com/# Tryggt apotek utan recept

apoteket rabattkod: Apotek online jamforelse – Kunder rankar basta apotek online

http://rabattapotek.com/# Rabatt Apotek

Medicijnen zonder recept bestellen: online apotheek – online apotheek nederland

Kundevurderinger av nettapotek Apotek på nett sammenligning Nettapotek med rask frakt

apotek pa nett: Rabatterte generiske medisiner – Rabatterte generiske medisiner

save on prescription drugs from Mexico: verified Mexican pharmacy promo codes – verified Mexican pharmacy promo codes

Kunder rankar bästa apotek online Tryggt apotek utan recept Bästa nätapotek 2025

https://kortingapotheek.com/# Online apotheek vergelijken

http://kortingapotheek.com/# online apotheek

Snabb leverans apoteksvaror online: Apotek online jämförelse – Tryggt apotek utan recept

farmacia online Italia: ScegliFarmacia – acquisto farmaci a domicilio Italia

farmacie senza ricetta online farmacie senza ricetta online top farmacia online

https://sceglifarmacia.com/# comprare medicinali online senza ricetta

mejores farmacias en linea: farmacias legales en Espana – farmacia online Espana

miglior farmacia online con sconti miglior farmacia online con sconti miglior farmacia online con sconti

farmacia online: comprare medicinali online senza ricetta – top farmacia online

https://pharmaclassement.com/# pharmacie en ligne France

farmacias sin receta en España mejores farmacias en línea farmacia online

classifica farmacie online: ScegliFarmacia – top farmacia online

https://tufarmaciatop.com/# farmacia con cupones descuento

Generika online kaufen Deutschland: Apotheken Radar – Apotheke Testsieger

Preisvergleich Online-Apotheken Deutschland Apotheken Radar Apotheken Radar

Rabattcode für Internetapotheke: Rabatte Apotheke online – online Apotheke Deutschland

http://sceglifarmacia.com/# ScegliFarmacia

Preisvergleich Online-Apotheken Deutschland Generika online kaufen Deutschland online Apotheke Deutschland

precios bajos en medicamentos online: farmacias legales en España – Tu Farmacia Top

http://pharmaclassement.com/# codes promo pharmacie web

http://tufarmaciatop.com/# mejores farmacias en línea

ScegliFarmacia: miglior farmacia online con sconti – farmacia online

ranking de farmacias online comprar medicamentos online sin receta farmacia barata online

zuverlässige Online-Apotheken: günstige Medikamente online – günstige Medikamente online

http://pharmaclassement.com/# PharmaClassement

Medikamente ohne Rezept online bestellen online apotheke Generika online kaufen Deutschland

PharmaClassement: acheter médicaments en ligne livraison rapide – médicaments sans ordonnance en ligne

https://pharmaclassement.com/# liste pharmacies en ligne fiables

http://apothekenradar.com/# Preisvergleich Online-Apotheken Deutschland

farmacias legales en Espana: Tu Farmacia Top – ranking de farmacias online

miglior farmacia online con sconti miglior farmacia online con sconti farmacia online

ScegliFarmacia: farmacia online Italia – classifica farmacie online

http://sceglifarmacia.com/# farmacie senza ricetta online

Apotheken Radar apotheke online bestellen Medikamente ohne Rezept online bestellen

http://sceglifarmacia.com/# farmacia online

Tu Farmacia Top: farmacias sin receta en Espana – farmacias legales en Espana

acheter médicaments en ligne livraison rapide: meilleures pharmacies en ligne françaises – pharmacie en ligne France

günstige Medikamente online ApothekenRadar Generika online kaufen Deutschland

https://sceglifarmacia.com/# farmacia online

pharmacie en ligne France: Pharma Classement – PharmaClassement

miglior farmacia online con sconti: farmacia online – ScegliFarmacia

günstige Medikamente online Apotheke Testsieger zuverlässige Online-Apotheken

https://apothekenradar.shop/# ApothekenRadar

codes promo pharmacie web: pharmacie en ligne – Pharma Classement

https://pharmaclassement.com/# médicaments sans ordonnance en ligne

https://apothekenradar.com/# beste online Apotheken Bewertung

Generika online kaufen Deutschland: online apotheke – Apotheke Testsieger

médicaments sans ordonnance en ligne liste pharmacies en ligne fiables pharmacie en ligne

https://pharmaclassement.shop/# PharmaClassement

AussieMedsHubAu: verified online chemists in Australia – best Australian pharmacies

Australian pharmacy reviews Aussie Meds Hub Aussie Meds Hub Australia

online pharmacy ireland

cheap medicines online Australia trusted online pharmacy Australia Australian pharmacy reviews

best Irish pharmacy websites

non-prescription medicines UK: UkMedsGuide – Uk Meds Guide

http://aussiemedshubau.com/# Aussie Meds Hub

pharmacy discount codes AU: cheap medicines online Australia – AussieMedsHubAu

non-prescription medicines UK non-prescription medicines UK trusted online pharmacy UK

online pharmacy: irishpharmafinder – discount pharmacies in Ireland

Irish online pharmacy reviews best Irish pharmacy websites Irish Pharma Finder

verified online chemists in Australia: best Australian pharmacies – AussieMedsHubAu

best Irish pharmacy websites

http://ukmedsguide.com/# cheap medicines online UK

affordable medication Ireland: affordable medication Ireland – irishpharmafinder

affordable medication Ireland: trusted online pharmacy Ireland – online pharmacy ireland

online pharmacy: online pharmacy – UkMedsGuide

best Irish pharmacy websites: online pharmacy – buy medicine online legally Ireland

best pharmacy sites with discounts online pharmacy reviews and ratings online pharmacy reviews and ratings

irishpharmafinder

trusted online pharmacy Australia: trusted online pharmacy Australia – cheap medicines online Australia

https://safemedsguide.com/# cheapest pharmacies in the USA

non-prescription medicines UK: non-prescription medicines UK – Uk Meds Guide

online pharmacy Irish online pharmacy reviews Irish online pharmacy reviews

best Irish pharmacy websites

online pharmacy: online pharmacy – online pharmacy

compare online pharmacy prices: online pharmacy – Safe Meds Guide

https://safemedsguide.com/# online pharmacy

Safe Meds Guide trusted online pharmacy USA SafeMedsGuide

pharmacy delivery Ireland

UK online pharmacies list: trusted online pharmacy UK – UkMedsGuide

pharmacy discount codes AU: pharmacy discount codes AU – cheap medicines online Australia

trusted online pharmacy Ireland

best Irish pharmacy websites: buy medicine online legally Ireland – online pharmacy

non-prescription medicines UK: cheap medicines online UK – Uk Meds Guide

best Australian pharmacies Aussie Meds Hub best Australian pharmacies

https://safemedsguide.shop/# promo codes for online drugstores

online pharmacy ireland

promo codes for online drugstores: online pharmacy reviews and ratings – compare online pharmacy prices

Aussie Meds Hub: compare pharmacy websites – trusted online pharmacy Australia

buy medicine online legally Ireland online pharmacy ireland best Irish pharmacy websites

verified online chemists in Australia: verified online chemists in Australia – AussieMedsHubAu

trusted online pharmacy UK: legitimate pharmacy sites UK – online pharmacy

legitimate pharmacy sites UK non-prescription medicines UK legitimate pharmacy sites UK

pharmacy delivery Ireland

http://irishpharmafinder.com/# buy medicine online legally Ireland

trusted online pharmacy UK: safe place to order meds UK – best UK pharmacy websites

affordable medication Ireland

Irish online pharmacy reviews: Irish Pharma Finder – best Irish pharmacy websites

online pharmacy reviews and ratings: buy medications online safely – best online pharmacy

affordable medications UK cheap medicines online UK UK online pharmacies list

irishpharmafinder

pharmacy online: Aussie Meds Hub – Australian pharmacy reviews

https://irishpharmafinder.com/# discount pharmacies in Ireland

Safe Meds Guide: top rated online pharmacies – best online pharmacy

AussieMedsHubAu online pharmacy australia trusted online pharmacy Australia

trusted online pharmacy Ireland

SafeMedsGuide: compare online pharmacy prices – top rated online pharmacies

trusted online pharmacy USA: top rated online pharmacies – cheapest pharmacies in the USA

compare pharmacy websites pharmacy discount codes AU cheap medicines online Australia

trusted online pharmacy Ireland

non-prescription medicines UK: safe place to order meds UK – UK online pharmacies list

verified online chemists in Australia: verified pharmacy coupon sites Australia – trusted online pharmacy Australia

https://safemedsguide.shop/# SafeMedsGuide

best Australian pharmacies best Australian pharmacies best Australian pharmacies

cheap medicines online UK: affordable medications UK – trusted online pharmacy UK

best UK pharmacy websites: affordable medications UK – best UK pharmacy websites

legitimate pharmacy sites UK UkMedsGuide non-prescription medicines UK

affordable medication Ireland

non-prescription medicines UK: legitimate pharmacy sites UK – UkMedsGuide

http://ukmedsguide.com/# safe place to order meds UK

online pharmacy reviews and ratings: compare online pharmacy prices – best pharmacy sites with discounts

affordable medications UK Uk Meds Guide online pharmacy

affordable medication Ireland

online pharmacy: pharmacy delivery Ireland – discount pharmacies in Ireland

trusted online pharmacy UK: online pharmacy – affordable medications UK

discount pharmacies in Ireland buy medicine online legally Ireland online pharmacy

https://mannvital.shop/# Viagra reseptfritt Norge

kamagra oral jelly: kamagra oral jelly – Kamagra 100mg prix France

kamagra oral jelly: kamagra – Kamagra oral jelly France

Spedra prezzo basso Italia: Avanafil senza ricetta – farmacia viva

Kamagra online kaufen: Kamagra Oral Jelly Deutschland – Potenzmittel ohne ärztliches Rezept

Kamagra 100mg prix France: Kamagra pas cher France – Sildenafil générique

acquistare Spedra online: Avanafil senza ricetta – differenza tra Spedra e Viagra

acquistare Spedra online: pillole per disfunzione erettile – comprare medicinali online legali

Kamagra sans ordonnance: Sildenafil générique – Kamagra 100mg prix France

https://vitalpharma24.shop/# Kamagra Wirkung und Nebenwirkungen

farmacia viva: acquistare Spedra online – Avanafil senza ricetta

differenza tra Spedra e Viagra: differenza tra Spedra e Viagra – differenza tra Spedra e Viagra

Kamagra sans ordonnance: Kamagra 100mg prix France – Vita Homme

Erfahrungen mit Kamagra 100mg: Kamagra online kaufen – Kamagra 100mg bestellen

acquistare Spedra online: Spedra – differenza tra Spedra e Viagra

Kamagra oral jelly France: VitaHomme – kamagra

Kamagra online kaufen: Potenzmittel ohne ärztliches Rezept – diskrete Lieferung per DHL

http://farmaciavivait.com/# pillole per disfunzione erettile

Kamagra sans ordonnance: Kamagra oral jelly France – Kamagra sans ordonnance

Kamagra Oral Jelly Deutschland: Kamagra online kaufen – Kamagra online kaufen

farmacia viva: comprare medicinali online legali – differenza tra Spedra e Viagra

kamagra oral jelly: Sildenafil générique – VitaHomme

Sildenafil uten resept: Sildenafil uten resept – nettapotek for menn

acquistare Spedra online: pillole per disfunzione erettile – acquistare Spedra online

Kamagra oral jelly France: acheter Kamagra en ligne – Kamagra livraison rapide en France

Kamagra online kaufen: Erfahrungen mit Kamagra 100mg – vitalpharma24

https://vitalpharma24.shop/# Kamagra online kaufen

Kamagra 100mg prix France: kamagra oral jelly – Kamagra oral jelly France

https://vitalpharma24.shop/# diskrete Lieferung per DHL

Potenzmittel ohne ärztliches Rezept: vitalpharma24 – vital pharma 24

Kamagra Wirkung und Nebenwirkungen: vitalpharma24 – Erfahrungen mit Kamagra 100mg

farmacia viva: FarmaciaViva – differenza tra Spedra e Viagra

comprare medicinali online legali: FarmaciaViva – Spedra prezzo basso Italia

Sildenafil tabletter pris: Sildenafil uten resept – viagra reseptfri

Kamagra Wirkung und Nebenwirkungen: diskrete Lieferung per DHL – Kamagra Oral Jelly Deutschland

https://mannvital.com/# billig Viagra Norge

nettapotek for menn: Sildenafil tabletter pris – generisk Viagra 50mg / 100mg

nettapotek for menn: generisk Viagra 50mg / 100mg – Sildenafil tabletter pris

https://vitalpharma24.com/# Potenzmittel ohne arztliches Rezept

kamagra oral jelly acheter Kamagra en ligne Kamagra livraison rapide en France

Sildenafil générique: kamagra oral jelly – Vita Homme

Kamagra livraison rapide en France: Kamagra sans ordonnance – Sildenafil générique

https://vitalpharma24.shop/# vital pharma 24

kamagra acheter Kamagra en ligne Sildenafil générique

Kamagra oral jelly France: Kamagra sans ordonnance – Kamagra oral jelly France

diskret leverans i Sverige: Sildenafil-tabletter pris – Sildenafil utan recept

https://herengezondheid.com/# HerenGezondheid

http://mediuomo.com/# comprare Sildenafil senza ricetta

Medi Uomo: Viagra generico con pagamento sicuro – trattamento ED online Italia

http://confiafarmacia.com/# Viagra generico online Espana

miglior sito per acquistare Sildenafil online: Viagra generico con pagamento sicuro – Medi Uomo

mannens apotek Viagra utan läkarbesök onlineapotek för män

https://mediuomo.com/# trattamento ED online Italia

billig Viagra Sverige: diskret leverans i Sverige – mannens apotek

MannensApotek: Sildenafil utan recept – Sildenafil utan recept

diskret leverans i Sverige köpa Viagra online Sverige MannensApotek

http://mannensapotek.com/# onlineapotek for man

mannens apotek: erektionspiller på nätet – Sildenafil-tabletter pris

https://confiafarmacia.shop/# ConfiaFarmacia

Medi Uomo MediUomo Viagra generico con pagamento sicuro

comprare Sildenafil senza ricetta: Viagra generico online Italia – trattamento ED online Italia

miglior sito per acquistare Sildenafil online: Viagra generico online Italia – farmaci per potenza maschile

köpa Viagra online Sverige köpa Viagra online Sverige mannens apotek

http://herengezondheid.com/# ED-medicatie zonder voorschrift

Sildenafil utan recept: erektionspiller på nätet – köp receptfria potensmedel online

comprar Sildenafilo sin receta: farmacia con entrega rápida – ConfiaFarmacia

http://mediuomo.com/# Viagra generico con pagamento sicuro

mannens apotek diskret leverans i Sverige billig Viagra Sverige

http://mediuomo.com/# pillole per disfunzione erettile

http://mannensapotek.com/# Sildenafil-tabletter pris

farmacia con entrega rápida: farmacia con entrega rápida – farmacia con entrega rápida

ED-medicatie zonder voorschrift: Viagra online kopen Nederland – HerenGezondheid

http://mediuomo.com/# miglior sito per acquistare Sildenafil online

Medi Uomo Viagra generico online Italia farmaci per potenza maschile

https://confiafarmacia.shop/# ConfiaFarmacia

ConfiaFarmacia: comprar Sildenafilo sin receta – farmacia con entrega rápida

farmacia confiable en España: pastillas de potencia masculinas – pastillas de potencia masculinas

Heren Gezondheid Viagra online kopen Nederland officiële Sildenafil webshop

https://mediuomo.shop/# comprare Sildenafil senza ricetta

comprare Sildenafil senza ricetta: ordinare Viagra generico in modo sicuro – Viagra generico con pagamento sicuro

billig Viagra Sverige: Viagra utan läkarbesök – Sildenafil utan recept

Sildenafil zonder recept bestellen ED-medicatie zonder voorschrift online apotheek zonder recept

trattamento ED online Italia: Viagra generico online Italia – farmaci per potenza maschile

http://mediuomo.com/# comprare Sildenafil senza ricetta

Viagra Г–sterreich rezeptfrei Apotheke: Potenzmittel rezeptfrei kaufen – Medi Vertraut

Viagra générique pas cher pharmacie en ligne fiable France Viagra sans ordonnance avis

https://santehommefrance.com/# pharmacie francaise agreee en ligne

prix du Viagra générique en France: prix du Viagra générique en France – Viagra générique pas cher

SanteHommeFrance: Viagra générique pas cher – Viagra générique pas cher

https://santehommefrance.com/# Viagra gГ©nГ©rique sans ordonnance en pharmacie

prix du Viagra générique en France: Quand une femme prend du Viagra homme – Viagra générique pas cher

discreet shipping for ED medication: viagra canada – BluePeakMeds

NHS Viagra cost alternatives licensed online pharmacy UK trusted British pharmacy

https://santehommefrance.com/# sildenafil 50 mg ou 100 mg posologie

https://santehommefrance.shop/# Viagra generique pas cher

MediVertraut Potenzmittel rezeptfrei kaufen Potenzmittel rezeptfrei kaufen

https://britmedsuk.shop/# affordable potency tablets

order Viagra discreetly: BritMedsUk – NHS Viagra cost alternatives

sichere Online-Apotheke Deutschland: Potenzmittel rezeptfrei kaufen – Potenzmittel rezeptfrei kaufen

ED medication online UK Brit Meds Uk Brit Meds Uk

https://britmedsuk.shop/# ED medication online UK

farmacia online madrid: farmacia en casa online descuento – comprar Cialis online España

potenzmittel cialis: cialis 20mg preis – shop apotheke gutschein

https://pilloleverdi.com/# tadalafil senza ricetta

tadalafilo: Cialis genérico económico – farmacia online fiable en España

farmacia online fiable en España: comprar cialis – tadalafilo sin receta

cialis sans ordonnance achat discret de Cialis 20mg cialis sans ordonnance

http://intimisante.com/# cialis 20 mg achat en ligne

https://intimisante.com/# IntimiSante

PotenzVital: gГјnstige online apotheke – cialis kaufen

cialis 20mg preis: cialis generika – shop apotheke gutschein

Potenz Vital potenzmittel cialis PotenzVital

https://intimisante.com/# cialis prix

tadalafil sans ordonnance: tadalafil sans ordonnance – cialis 20 mg achat en ligne

acquistare Cialis online Italia: dove comprare Cialis in Italia – migliori farmacie online 2024

cialis kaufen Cialis Preisvergleich Deutschland Cialis Preisvergleich Deutschland

http://potenzvital.com/# cialis kaufen ohne rezept

http://tadalafiloexpress.com/# cialis generico

Tadalafilo Express: Tadalafilo Express – farmacia online 24 horas

cialis kaufen ohne rezept cialis kaufen cialis kaufen

livraison rapide et confidentielle: pharmacie qui vend du cialis sans ordonnance – cialis sans ordonnance

https://pilloleverdi.com/# miglior prezzo Cialis originale

tadalafilo sin receta tadalafilo sin receta Cialis genérico económico

https://potenzvital.shop/# Cialis generika gunstig kaufen

pharmacie en ligne france pas cher: IntimiSanté – livraison rapide et confidentielle

cialis generico cialis generico farmacia online envГo gratis

comprar cialis: comprar cialis – tadalafilo 5 mg precio

Cialis genérico económico Cialis genérico económico tadalafilo sin receta

farmacie online sicure: cialis prezzo – miglior prezzo Cialis originale

https://tadalafiloexpress.shop/# comprar cialis

acquistare Cialis online Italia acquistare Cialis online Italia dove comprare Cialis in Italia

livraison rapide et confidentielle: tadalafil sans ordonnance – Cialis générique pas cher

https://intimisante.com/# Intimi Sante

miglior prezzo Cialis originale: cialis generico – farmacia online italiana Cialis

cialis generico Cialis genérico económico comprar cialis

cialis sans ordonnance: achat discret de Cialis 20mg – cialis generique

https://zencaremeds.shop/# online pharmacy

tadalafil tablets without prescription Cialis online USA safe online pharmacy for Cialis

buy cialis online: tadalafil tablets without prescription – TadaLife Pharmacy

Cialis online USA: buy cialis online – generic Cialis online pharmacy

http://medicosur.com/# mexican medicine

MedicoSur MedicoSur mexican online pharmacy wegovy

MedicoSur: MedicoSur – MedicoSur

purple pharmacy: mexican medicine – mexican pharmacy

http://medicosur.com/# mexican pharmacy

tadalafil tablets without prescription: trusted online pharmacy for ED meds – cialis

online pharmacy order antibiotics from mexico pharmacy delivery

MedicoSur: mexico pharmacy – MedicoSur

MedicoSur mexican pharmacy mexico pharmacy

buy cialis online: buy cialis online – safe online pharmacy for Cialis

http://medicosur.com/# purple pharmacy online

MedicoSur: MedicoSur – mexican pharmacy

mexican pharmacy: mexico pharmacy – farmacia mexicana online

https://tadalifepharmacy.shop/# tadalafil tablets without prescription

online pharmacy buy amoxil trusted online pharmacy USA

online pharmacy: order medicine discreetly USA – rx pharmacy

discreet ED pills delivery in the US: discreet ED pills delivery in the US – cialis

http://zencaremeds.com/# ZenCare Meds

http://medicosur.com/# pharmacy in mexico that ships to us

MedicoSur mexico pharmacy mexico pharmacy

generic Cialis online pharmacy: trusted online pharmacy for ED meds – discreet ED pills delivery in the US

trusted online pharmacy USA: ZenCareMeds – ZenCare Meds

https://tadalifepharmacy.shop/# TadaLife Pharmacy

BritMeds Direct: private online pharmacy UK – pharmacy online UK

viagra uk: British online pharmacy Viagra – buy viagra online

cheap amoxicillin amoxicillin uk UK online antibiotic service

https://amoxicareonline.com/# amoxicillin uk

http://amoxicareonline.com/# buy amoxicillin

UK online pharmacy without prescription: BritMeds Direct – UK online pharmacy without prescription

generic amoxicillin: cheap amoxicillin – generic amoxicillin

Amoxicillin online UK buy amoxicillin amoxicillin uk

https://britmedsdirect.shop/# BritMeds Direct

private online pharmacy UK: UK online pharmacy without prescription – private online pharmacy UK

https://britmedsdirect.com/# order medication online legally in the UK

Prednisolone tablets UK online: best UK online chemist for Prednisolone – UK chemist Prednisolone delivery

UK online pharmacy without prescription: BritMeds Direct – online pharmacy

BritPharm Online: order ED pills online UK – viagra

buy prednisolone: MedRelief UK – MedRelief UK

Brit Meds Direct: private online pharmacy UK – order medication online legally in the UK

https://britmedsdirect.com/# Brit Meds Direct

British online pharmacy Viagra: British online pharmacy Viagra – buy viagra

order steroid medication safely online: UK chemist Prednisolone delivery – MedRelief UK

viagra buy sildenafil tablets UK buy viagra

https://medreliefuk.com/# buy corticosteroids without prescription UK

generic Amoxicillin pharmacy UK: Amoxicillin online UK – amoxicillin uk

UK online antibiotic service: UK online antibiotic service – buy amoxicillin

Brit Meds Direct private online pharmacy UK pharmacy online UK

pharmacy online UK: BritMeds Direct – order medication online legally in the UK

https://medreliefuk.shop/# cheap prednisolone in UK

viagra: British online pharmacy Viagra – Viagra online UK

Brit Meds Direct Brit Meds Direct pharmacy online UK

UK chemist Prednisolone delivery: cheap prednisolone in UK – MedRelief UK

Brit Meds Direct online pharmacy online pharmacy

https://britpharmonline.shop/# buy sildenafil tablets UK

http://britmedsdirect.com/# BritMeds Direct

buy corticosteroids without prescription UK: order steroid medication safely online – best UK online chemist for Prednisolone

British online pharmacy Viagra BritPharm Online British online pharmacy Viagra

https://amoxicareonline.com/# amoxicillin uk

Prednisone without prescription USA Prednisone tablets online USA Prednisone tablets online USA

trusted Stromectol source online: generic ivermectin online pharmacy – Stromectol ivermectin tablets for humans USA

Tadalafil tablets: FDA-approved Tadalafil generic – safe online pharmacy for ED pills

https://medivermonline.shop/# generic ivermectin online pharmacy

low-cost ivermectin for Americans

order Stromectol discreet shipping USA Stromectol ivermectin tablets for humans USA trusted Stromectol source online

generic ivermectin online pharmacy: Stromectol ivermectin tablets for humans USA – ivermectin covid studies

https://medivermonline.shop/# Mediverm Online

order Stromectol discreet shipping USA

how to purchase prednisone online how to get Prednisone legally online Prednisone without prescription USA

gabapentin brand name: generic gabapentin pharmacy USA – NeuroCare Direct

https://medivermonline.com/# generic ivermectin online pharmacy

Stromectol ivermectin tablets for humans USA

https://everlastrx.com/# tadalafil generic in usa

order gabapentin discreetly: is gabapentin good for sleep – order gabapentin discreetly

https://neurocaredirect.shop/# gabapentin capsules for nerve pain

neuropathic pain relief treatment online gabapentin for uremic pruritus gabapentin capsules for nerve pain

gabapentin capsules for nerve pain: Neurontin online without prescription USA – generic gabapentin pharmacy USA

https://neurocaredirect.com/# affordable Neurontin medication USA

online pharmacy Prednisone fast delivery: how to get Prednisone legally online – how to get Prednisone legally online

EverLastRx: FDA-approved Tadalafil generic – FDA-approved Tadalafil generic

https://medivermonline.shop/# Stromectol ivermectin tablets for humans USA

generic tadalafil in canada EverLastRx discreet delivery for ED medication

prednisone 30: order prednisone online canada – prednisone in canada

tadalafil tablets: tadalafil 40 mg online india – FDA-approved Tadalafil generic

https://neurocaredirect.com/# Neurontin online without prescription USA

Mediverm Online: Mediverm Online – Stromectol ivermectin tablets for humans USA

https://predniwellonline.shop/# PredniWell Online

how to get Prednisone legally online: Prednisone tablets online USA – how to get Prednisone legally online

Mediverm Online Mediverm Online generic ivermectin online pharmacy

Neurontin online without prescription USA: affordable Neurontin medication USA – FDA-approved gabapentin alternative

https://predniwellonline.shop/# Prednisone without prescription USA

how to get Prednisone legally online: how to get Prednisone legally online – how to get Prednisone legally online

buy prednisone with paypal canada how to get Prednisone legally online online pharmacy Prednisone fast delivery

Neurontin online without prescription USA: gabapentin capsules for nerve pain – neuropathic pain relief treatment online

buy tadalafil online without a prescription: FDA-approved Tadalafil generic – FDA-approved Tadalafil generic

how to get Prednisone legally online: how to get Prednisone legally online – Prednisone tablets online USA

Neurontin online without prescription USA: generic gabapentin pharmacy USA – affordable Neurontin medication USA

https://everlastrx.shop/# FDA-approved Tadalafil generic

Clomid price ClomiCare USA Clomid for sale

Propecia 1mg price: Propecia prescription – buy finasteride

Clomid fertility: ClomiCare USA – Clomid for sale

buy amoxicillin Purchase amoxicillin online Amoxicillin 500mg buy online

ClomiCare USA: ClomiCare USA – ClomiCare USA

https://amoxdirectusa.com/# azithromycin amoxicillin

Propecia prescription: Propecia prescription – Best place to buy propecia

Amoxicillin 500mg buy online AmoxDirect USA buy amoxil

Propecia 1mg price: Propecia prescription – Propecia buy online

Clomid fertility: Clomid fertility – Clomid price

Clomid fertility: Clomid for sale – get cheap clomid

https://amoxdirectusa.com/# Purchase amoxicillin online

buy zithromax online: generic zithromax – buy zithromax online

buying generic propecia without prescription buy propecia RegrowRx Online

https://zithromedsonline.com/# cheap zithromax

https://regrowrxonline.shop/# Best place to buy propecia

AmoxDirect USA: buy amoxil – Purchase amoxicillin online

cheap zithromax ZithroMeds Online zithromax 500 mg lowest price drugstore online

Generic Clomid: Clomid fertility – clomid medication

ClomiCare USA Clomid for sale Clomid fertility

Propecia prescription: RegrowRx Online – Propecia buy online

Purchase amoxicillin online: Amoxicillin 500mg buy online – buy amoxicillin

https://regrowrxonline.com/# cost propecia without a prescription

https://amoxdirectusa.com/# buy amoxicillin

generic zithromax buy zithromax online generic zithromax

Purchase amoxicillin online: Purchase amoxicillin online – AmoxDirect USA

Purchase amoxicillin online: Purchase amoxicillin online – buy amoxil

https://clomicareusa.shop/# Clomid fertility

Sildenafil 100mg sildenafil 50 mg tablet buy online Sildenafil 100mg price

MedicExpress MX: MedicExpress MX – Best online Mexican pharmacy

Generic Cialis without a doctor prescription: Generic Cialis without a doctor prescription – Generic tadalafil 20mg price

https://truevitalmeds.com/# cheap sildenafil

https://tadalmedspharmacy.com/# Buy Tadalafil online

Buy sildenafil online usa: Buy sildenafil – sildenafil

https://medicexpressmx.com/# Best online Mexican pharmacy

Sildenafil 100mg: sildenafil – sildenafil

Buy Tadalafil online tadalafil tablets Buy Tadalafil online

https://tadalmedspharmacy.com/# Generic tadalafil 20mg price

https://truevitalmeds.com/# Sildenafil 100mg

Buy sildenafil: buy sildenafil online india – Sildenafil 100mg price

Buy Tadalafil online tadalafil Generic Cialis without a doctor prescription

https://tadalmedspharmacy.com/# tadalafil

Sildenafil 100mg price: Buy sildenafil – sildenafil prices in india

sildenafil canadian pharmacy sildenafil 100mg sildenafil tablet price

http://tadalmedspharmacy.com/# buy generic tadalafil online cheap

Legit online Mexican pharmacy: mexican pharmacy – Legit online Mexican pharmacy

mexican pharmacy: Online Mexican pharmacy – Best online Mexican pharmacy

https://tadalmedspharmacy.shop/# tadalafil soft gel capsule 20mg

http://truevitalmeds.com/# Buy sildenafil online usa

Generic tadalafil 20mg price buy generic tadalafil online Generic Cialis without a doctor prescription

tadalafil cialis: Buy Tadalafil 20mg – Buy Tadalafil online

https://chickenroadslotitalia.com/# Chicken Road slot machine online

slot a tema fattoria Italia: giri gratis Chicken Road casino Italia – giocare Chicken Road gratis o con soldi veri

how to win Chicken Road slot game: free demo Chicken Road game – Chicken Road slot game India

bonus Plinko slot Italia bonus Plinko slot Italia bonus Plinko slot Italia

https://chickenroadslotuk.shop/# British online casinos with Chicken Road

play Chicken Road casino online: play Chicken Road casino online – how to win Chicken Road slot game

Chicken Road slot game India: secure online gambling India – secure online gambling India

play Chicken Road casino online UK Chicken Road slot UK casino promotions Chicken Road game

best Indian casinos with Chicken Road: Chicken Road slot game India – bonus spins Chicken Road casino India

play Chicken Road casino online: secure online gambling India – play Chicken Road casino online

http://chickenroadslotitalia.com/# Chicken Road slot machine online

real money slot Chicken Road UK: casino promotions Chicken Road game – UK players free spins Chicken Road

UK players free spins Chicken Road casino promotions Chicken Road game UK players free spins Chicken Road

casino promotions Chicken Road game: UK players free spins Chicken Road – British online casinos with Chicken Road

giri gratis Chicken Road casino Italia: recensione Chicken Road slot – recensione Chicken Road slot

casino promotions Chicken Road game: casino promotions Chicken Road game – real money slot Chicken Road UK

Plinko: gioco Plinko mobile Italia – Plinko gioco a caduta palline

free demo Chicken Road game Chicken Road slot game India best Indian casinos with Chicken Road

http://nordapotekno.com/# nettapotek Norge trygt og palitelig

comprar medicinas online sin receta medica medicamentos sin receta a domicilio medicamentos sin receta a domicilio

farmaci senza prescrizione disponibili online: spedizione rapida farmaci Italia – farmacia online Italia affidabile

SaludExpress SaludExpress farmacia con envio rapido y seguro

https://nordapotekno.shop/# reseptfrie medisiner pa nett

farmacia con envío rápido y seguro: medicamentos sin receta a domicilio – farmacia online españa

apotheek zonder receptplicht Holland Apotheek online apotheek

online apotheek: online apotheek Nederland betrouwbaar – goedkope medicijnen online

HollandApotheek: veilig online apotheek NL – discrete levering van medicijnen

goedkope medicijnen online: online apotheek Nederland betrouwbaar – online apotheek Nederland betrouwbaar

https://nordapotekno.shop/# apotek pa nett

billige generiske legemidler Norge: billige generiske legemidler Norge – apotek på nett

medicamentos sin receta a domicilio: pedir fármacos por Internet – farmacia online España fiable

medicamentos sin receta a domicilio farmacia online Espana fiable medicamentos sin receta a domicilio

FarmaciaFacile medicinali generici a basso costo acquisto farmaci con ricetta

billige generiske legemidler Norge: apotek på nett med gode priser – NordApotek

apotek på nett med gode priser: apotek på nett – kundevurderinger av nettapotek

SaludExpress SaludExpress medicamentos sin receta a domicilio

spedizione rapida farmaci Italia: farmacia online Italia affidabile – medicinali generici a basso costo

billiga lakemedel pa natet: generiska lakemedel online – apotheke online

п»їshop apotheke gutschein: kamagra kaufen – online apotheke gГјnstig

http://nordicapotek.com/# diskret leverans av mediciner

eu apotheke ohne rezept Kamagra Preis Deutschland internet apotheke

online apotheke preisvergleich: Medikamente ohne Rezept bestellen – beste online-apotheke ohne rezept

bestalla medicin utan recept: Nordic Apotek – online apotheke deutschland

onlineapotek Sverige: hälsolösningar online Sverige – online apotheke

online apotheke preisvergleich Medikamente ohne Rezept bestellen gГјnstigste online apotheke

eu apotheke ohne rezept: ApothekeDirekt24 – gГјnstigste online apotheke

online apotheke preisvergleich: Apotheke mit schneller Lieferung – online apotheke gГјnstig

https://nordicapotek.shop/# bestalla medicin utan recept

online apotheke preisvergleich Kamagra Deutschland Apotheke internet apotheke

NordicApotek: NordicApotek – online apotheke deutschland

mexican pharmacy Best Mexican pharmacy online mexico pet pharmacy

indian pharmacy: Best Indian pharmacy – Indian pharmacy to USA

Pharmacies in Canada that ship to the US: Canadian pharmacy prices – Canadian pharmacy online

MapleCareRx: MapleCareRx – Pharmacies in Canada that ship to the US

canadian pharmacy: Pharmacies in Canada that ship to the US – reputable canadian online pharmacies

BajaMedsDirect mexico pharmacy BajaMedsDirect

Indian pharmacy online: india pharmacy – CuraMedsIndia

Canadian pharmacy online: Canadian pharmacy online – Canadian pharmacy online

Best online Indian pharmacy Best online Indian pharmacy pharmacy websites

https://bajamedsdirect.shop/# Online Mexican pharmacy

Pharmacies in Canada that ship to the US: Canadian pharmacy online – canadian pharmacy

Mexican pharmacy ship to USA: Best Mexican pharmacy online – mexican pharmacy

canadian family pharmacy MapleCareRx Canadian pharmacy online

indian pharmacy: Indian pharmacy ship to USA – Best Indian pharmacy

Pharmacies in Canada that ship to the US Pharmacies in Canada that ship to the US Canadian pharmacy prices

http://maplecarerx.com/# MapleCareRx

indian pharmacy: indian pharmacy – Indian pharmacy to USA

Canadian pharmacy prices: Canadian pharmacy prices – Canadian pharmacy online

MapleCareRx MapleCareRx Canadian pharmacy online

MapleCareRx: Canadian pharmacy prices – Pharmacies in Canada that ship to the US

Indian pharmacy online: indian pharmacy – Indian pharmacy to USA

MapleCareRx: Canadian pharmacy online – canadian pharmacy

http://maplecarerx.com/# Canadian pharmacy prices

https://clearmedshub.com/# ClearMedsHub

ed pills: VitalEdge Pharma – VitalEdge Pharma

Buy Tadalafil 5mg Ever Trust Meds Cialis 20mg price

EverTrustMeds: Ever Trust Meds – cheapest cialis

http://clearmedshub.com/# Clear Meds Hub

EverTrustMeds: EverTrustMeds – Buy Cialis online

Clear Meds Hub

https://evertrustmeds.shop/# EverTrustMeds

https://evertrustmeds.shop/# buy cialis pill

: Clear Meds Hub – Clear Meds Hub

Ever Trust Meds: Cialis 20mg price – EverTrustMeds

VitalEdge Pharma cheapest ed online VitalEdge Pharma

https://clearmedshub.shop/# ClearMedsHub

http://vitaledgepharma.com/# VitalEdgePharma

: ClearMedsHub –

Ever Trust Meds Generic Tadalafil 20mg price EverTrustMeds

EverTrustMeds: EverTrustMeds – EverTrustMeds

ClearMedsHub

http://vitaledgepharma.com/# cheap ed drugs

https://evertrustmeds.com/# Buy Tadalafil 20mg

: Clear Meds Hub – Clear Meds Hub

VitalEdgePharma: where can i buy ed pills – VitalEdgePharma

ed rx online buy ed meds online VitalEdge Pharma

ClearMedsHub: Clear Meds Hub – ClearMedsHub

Ever Trust Meds: Cialis 20mg price – cialis generic

http://clearmedshub.com/#

Ever Trust Meds Ever Trust Meds Cialis over the counter

https://evertrustmeds.com/# п»їcialis generic

Cheap Cialis: Ever Trust Meds – Tadalafil price

Intim Gesund: kamagra kaufen ohne rezept online – Viagra kaufen gГјnstig

online apotheke rezept blaue pille erfahrungen manner online apotheke rezept

internet apotheke: rezeptfreie arzneimittel online kaufen – online apotheke preisvergleich

https://mannerkraft.com/# gГјnstigste online apotheke

gГјnstige online apotheke Blau Kraft internet apotheke

kamagra erfahrungen deutschland: IntimGesund – Viagra Alternative rezeptfrei

http://intimgesund.com/# kamagra kaufen ohne rezept online

kamagra oral jelly deutschland bestellen: IntimGesund – Wo kann man Viagra kaufen rezeptfrei

online apotheke: Manner Kraft – п»їshop apotheke gutschein

medikamente rezeptfrei cialis generika ohne rezept tadalafil 20mg preisvergleich

http://gesunddirekt24.com/# п»їshop apotheke gutschein

https://blaukraftde.shop/# online apotheke

preisvergleich kamagra tabletten: IntimGesund – Viagra online kaufen legal in Deutschland

generisches sildenafil alternative: IntimGesund – Viagra Tabletten

gГјnstige online apotheke PotenzApotheke Potenz Apotheke

cialis generika ohne rezept: cialis generika ohne rezept – günstigste online apotheke

wirkung und dauer von tadalafil: wirkung und dauer von tadalafil – online apotheke versandkostenfrei

SaludFrontera purple pharmacy online SaludFrontera

https://curabharatusa.shop/# online pharmacy store

pharmacy in mexico: farmacias online usa – farmacia online usa

indian pharmacy: CuraBharat USA – CuraBharat USA

canadian pharmacy king reviews: buy prescription drugs from canada cheap – legitimate canadian pharmacy online

purple pharmacy online SaludFrontera SaludFrontera

SaludFrontera: prescriptions from mexico – my mexican pharmacy

the purple pharmacy mexico SaludFrontera SaludFrontera

https://truenorthpharm.shop/# TrueNorth Pharm

adderall canadian pharmacy: canadian world pharmacy – TrueNorth Pharm

https://truenorthpharm.shop/# canadapharmacyonline

SaludFrontera: SaludFrontera – mexican drug stores

CuraBharat USA CuraBharat USA CuraBharat USA

mexico meds: best mexican online pharmacy – medication in mexico

https://saludfrontera.shop/# order medicine from mexico

pharmacy in mexico online SaludFrontera mexican farmacia

SaludFrontera: SaludFrontera – best pharmacy in mexico

how to order medicine online: buy medicine online in india – CuraBharat USA

mexico pet pharmacy SaludFrontera SaludFrontera

https://bluepilluk.shop/# fast delivery viagra UK online

sildenafil tablets online order UK: sildenafil tablets online order UK – fast delivery viagra UK online

https://intimacareuk.com/# IntimaCare UK

stromectol pills home delivery UK MediTrust UK ivermectin without prescription UK

generic and branded medications UK: order medicines online discreetly – cheap UK online pharmacy

IntimaCare UK weekend pill UK online pharmacy IntimaCareUK

viagra discreet delivery UK http://mediquickuk.com/# MediQuick UK

https://mediquickuk.com/# MediQuickUK

UK pharmacy home delivery order medicines online discreetly UK pharmacy home delivery

discreet ivermectin shipping UK: ivermectin cheap price online UK – MediTrust UK

BluePill UK https://intimacareuk.shop/# confidential delivery cialis UK

viagra discreet delivery UK BluePillUK sildenafil tablets online order UK

BluePill UK generic sildenafil UK pharmacy order viagra online safely UK

http://intimacareuk.com/# IntimaCare UK

viagra discreet delivery UK: BluePillUK – viagra discreet delivery UK

https://intimacareuk.com/# tadalafil generic alternative UK

viagra discreet delivery UK https://intimacareuk.com/# IntimaCare UK

stromectol pills home delivery UK: ivermectin cheap price online UK – generic stromectol UK delivery

http://evergreenrxusas.com/# EverGreenRx USA

EverGreenRx USA cialis generic cvs EverGreenRx USA

https://evergreenrxusas.com/# does tadalafil work

cialis insurance coverage blue cross: buying generic cialis – cialis generic timeline 2018

https://evergreenrxusas.shop/# EverGreenRx USA

cialis 100 mg usa generic cialis tadalafil 20mg reviews EverGreenRx USA

cialis super active plus reviews: tadalafil cheapest online – cialis generic over the counter

EverGreenRx USA: EverGreenRx USA – EverGreenRx USA

order cialis online cheap generic EverGreenRx USA EverGreenRx USA

kratonbet link kratonbet login kratonbet login

situs slot batara88 batarabet login batarabet alternatif

https://linktr.ee/mawartotol# mawartoto slot

kratonbet login: kratonbet login – kratonbet

batara88: batara88 – batarabet login

hargatoto slot hargatoto slot toto slot hargatoto

https://linkr.bio/betawi777# betawi77 link alternatif

https://linktr.ee/mawartotol# mawartoto alternatif

betawi77 login betawi77 link alternatif betawi77 net

hargatoto alternatif hargatoto alternatif toto slot hargatoto

https://tap.bio/@hargatoto# hargatoto slot

Blue Pharma pilule bleue en ligne viagra generique efficace

https://pharmalibrefrance.shop/# PharmaLibre France

https://intimapharmafrance.shop/# cialis sans ordonnance

kamagra gel oral livraison discrete France: kamagra 100 mg prix competitif en ligne – kamagra gel oral livraison discrete France

http://pharmalibrefrance.com/# commander kamagra en toute confidentialite

https://pharmaexpressfrance.com/# pharmacie en ligne france pas cher

Viagra Pfizer sans ordonnance: Acheter viagra en ligne livraison 24h – sildenafil citrate 100 mg

acheter medicaments en ligne pas cher PharmaExpress pharmacie en ligne avec ordonnance

Pharma Libre: PharmaLibre France – PharmaLibre

PharmaLibre France commander kamagra en toute confidentialite acheter kamagra pas cher livraison rapide

https://vitalcorepharm.com/# ed online pharmacy

buy antibiotics for tooth infection: antibiotics over the counter – buy antibiotics online safely

drugs from canada online canadian pharmacy reviews canadian pharmacy antibiotics

https://clearmedspharm.shop/# buy antibiotics for tooth infection

where can i buy ed pills: erection pills online – ed pills

ed pills: VitalCore – ed pills

TrueMeds best pharmacy online pharmacy pain medicine

https://vitalcorepharm.com/# VitalCore

low cost ed medication: VitalCore – VitalCore Pharmacy

http://clearmedspharm.com/# buy antibiotics for tooth infection

canadian pharmacy: TrueMeds Pharmacy – canadian pharmacy cialis

ClearMeds ClearMeds antibiotics over the counter

https://truemedspharm.com/# TrueMeds Pharmacy

VitalCore: ed pills – ed pills

TrueMeds Pharmacy: canadian pharmacy no rx needed – cheapest pharmacy prescription drugs

TrueMeds canadadrugpharmacy com TrueMeds

ed pills: VitalCore Pharmacy – online ed prescription

http://truemedspharm.com/# safe reliable canadian pharmacy

https://vitalcorepharm.shop/# ed drugs online

order ed meds online: VitalCore Pharmacy – cheap ed meds online

buy antibiotics online: buy antibiotics online – buy antibiotics online safely

ClearMeds Pharmacy buy antibiotics online safely buy antibiotics for tooth infection

http://truemedspharm.com/# TrueMeds

link alternatif garuda888 terbaru link alternatif garuda888 terbaru garuda888 login resmi tanpa ribet

giri gratis Book of Ra Deluxe: migliori casino online con Book of Ra – migliori casino online con Book of Ra

slot gacor hari ini preman69: 1win69 – preman69 situs judi online 24 jam

recensioni Book of Ra Deluxe slot: Book of Ra Deluxe soldi veri – Book of Ra Deluxe soldi veri

bonaslot jackpot harian jutaan rupiah: bonaslot jackpot harian jutaan rupiah – bonaslot jackpot harian jutaan rupiah

https://1win888indonesia.com/# agen garuda888 bonus new member

preman69 slot gacor hari ini preman69 slot gacor hari ini preman69

1win888indonesia: agen garuda888 bonus new member – 1win888indonesia

daftar garuda888 mudah dan cepat: link alternatif garuda888 terbaru – garuda888 live casino Indonesia

Starburst giri gratis senza deposito: jackpot e vincite su Starburst Italia – Starburst slot online Italia

preman69 login tanpa ribet: promosi dan bonus harian preman69 – 1win69

preman69 login: preman69 – promosi dan bonus harian preman69

bonaslot link resmi mudah diakses bonaslot situs bonus terbesar Indonesia bonaslot link resmi mudah diakses

bonaslot jackpot harian jutaan rupiah: bonaslot jackpot harian jutaan rupiah – bonaslot link resmi mudah diakses

daftar garuda888 mudah dan cepat: agen garuda888 bonus new member – link alternatif garuda888 terbaru

jackpot e vincite su Starburst Italia: migliori casino online con Starburst – giocare da mobile a Starburst

agen garuda888 bonus new member daftar garuda888 mudah dan cepat garuda888 game slot RTP tinggi

1wbona: bonaslot login – bonaslot

https://1wbona.shop/# bonaslot link resmi mudah diakses

garuda888 slot online terpercaya: garuda888 slot online terpercaya – garuda888 login resmi tanpa ribet

1win69: preman69 login – preman69 login tanpa ribet

bonaslot link resmi mudah diakses: bonaslot login – bonaslot link resmi mudah diakses

purple pharmacy mexico price list: BorderMeds Express – BorderMeds Express

mexico pharmacy BorderMeds Express order azithromycin mexico

BorderMeds Express: BorderMeds Express – BorderMeds Express

https://maplemedsdirect.com/# MapleMeds Direct

best prices on finasteride in mexico: BorderMeds Express – order kamagra from mexican pharmacy

mexico drug stores pharmacies: BorderMeds Express – BorderMeds Express

legit mexican pharmacy without prescription BorderMeds Express mexico pharmacy

trusted mexican pharmacy: order from mexican pharmacy online – BorderMeds Express

finasteride mexico pharmacy: BorderMeds Express – order azithromycin mexico

https://bordermedsexpress.com/# mexico drug stores pharmacies

legit mexican pharmacy without prescription: BorderMeds Express – BorderMeds Express

BharatMeds Direct: best india pharmacy – BharatMeds Direct

Super ED Trial Pack: online pharmacy without a prescription – target pharmacy lamictal

pharmacy viagra MapleMeds Direct MapleMeds Direct

buy prescription drugs from india: BharatMeds Direct – BharatMeds Direct

buy from mexico pharmacy: BorderMeds Express – BorderMeds Express

MapleMeds Direct Nimotop MapleMeds Direct

india pharmacy: BharatMeds Direct – india pharmacy

https://bharatmedsdirect.com/# BharatMeds Direct

BorderMeds Express: BorderMeds Express – BorderMeds Express

BorderMeds Express: buy propecia mexico – BorderMeds Express

Online medicine home delivery best india pharmacy top 10 pharmacies in india

MapleMeds Direct: MapleMeds Direct – viagra shanghai pharmacy

BorderMeds Express: BorderMeds Express – get viagra without prescription from mexico

indian pharmacy paypal: BharatMeds Direct – BharatMeds Direct

generic viagra online us pharmacy MapleMeds Direct MapleMeds Direct

BharatMeds Direct: pharmacy website india – india pharmacy mail order

http://bordermedsexpress.com/# mexican border pharmacies shipping to usa

dostinex online pharmacy: MapleMeds Direct – Isoptin SR

pharmacy selling cytotec: pharmacy india cialis – nexium online pharmacy

BorderMeds Express: BorderMeds Express – BorderMeds Express

BharatMeds Direct: buy medicines online in india – BharatMeds Direct

https://bordermedsexpress.com/# mexican mail order pharmacies

viagra us pharmacy online: people’s pharmacy celebrex – MapleMeds Direct

best mexican pharmacy online: BorderMeds Express – buy modafinil from mexico no rx

viagra generico in farmacia costo: Potenza Facile – viagra naturale

viagra 50 mg prezzo in farmacia sildenafil senza ricetta viagra generico recensioni

farmacia online: medicinali senza prescrizione medica – migliori farmacie online 2024

http://forzaintima.com/# consegna rapida e riservata kamagra

Farmacia online piГ№ conveniente consegna rapida e riservata kamagra Farmacie online sicure

farmacie online sicure: farmacia online Italia – acquisto farmaci con ricetta

farmacia online senza ricetta: farmacia online cialis Italia – Farmacia online più conveniente

farmaci senza ricetta elenco: sildenafil generico senza ricetta – п»їFarmacia online migliore

Farmacia online piГ№ conveniente comprare farmaci online all’estero farmaci senza ricetta elenco

farmacia online senza ricetta: Forza Intima – Farmacie online sicure

farmacie online autorizzate elenco: Farmacie online sicure – farmacie online sicure

farmacie online autorizzate elenco: tadalafil 10mg 20mg disponibile online – п»їFarmacia online migliore

https://farmacidiretti.com/# farmacia online

viagra subito sildenafil senza ricetta siti sicuri per comprare viagra online

Farmacia online migliore: accesso rapido a cialis generico online – Farmacia online migliore

farmacie online autorizzate elenco: ForzaIntima – comprare farmaci online all’estero

CardioMeds Express CardioMeds Express lasix medication

lasix furosemide: CardioMeds Express – CardioMeds Express

https://ivergrove.com/# IverGrove

SteroidCare Pharmacy: SteroidCare Pharmacy – SteroidCare Pharmacy

ivermectin praziquantel for dogs: IverGrove – ivermectin for cats mange

furosemide furosemide 40 mg lasix uses

FertiCare Online: FertiCare Online – can i order generic clomid tablets

CardioMeds Express: lasix uses – CardioMeds Express

https://cardiomedsexpress.shop/# lasix uses

amoxil generic: TrustedMeds Direct – amoxicillin generic

where can i buy clomid: how to buy generic clomid without prescription – FertiCare Online

amoxicillin buy no prescription: TrustedMeds Direct – TrustedMeds Direct

prednisone 40 mg tablet: average cost of prednisone – SteroidCare Pharmacy

CardioMeds Express: CardioMeds Express – CardioMeds Express

CardioMeds Express: CardioMeds Express – lasix 100 mg

CardioMeds Express: lasix 40mg – CardioMeds Express

https://trustedmedsdirect.shop/# TrustedMeds Direct

ivermectin for scabies in humans: IverGrove – IverGrove

FertiCare Online: FertiCare Online – cost of clomid no prescription

TrustedMeds Direct TrustedMeds Direct TrustedMeds Direct

FertiCare Online: order generic clomid without insurance – how to buy clomid online

CardioMeds Express: lasix 40 mg – buy furosemide online

amoxicillin over the counter in canada: amoxicillin cephalexin – amoxicillin canada price

prednisone buy cheap generic prednisone for sale prednisone daily

Kamagra reviews from US customers: Sildenafil oral jelly fast absorption effect – Sildenafil oral jelly fast absorption effect

SildenaPeak: SildenaPeak – SildenaPeak

Tadalify: Tadalify – mambo 36 tadalafil 20 mg

cialis online usa cialis 20mg Tadalify

best generic viagra from india: brand viagra – SildenaPeak

http://tadalify.com/# cialis for daily use side effects

viagra medicine online purchase: order viagra online australia – real viagra pills for sale

Sildenafil oral jelly fast absorption effect: Online sources for Kamagra in the United States – KamaMeds

http://kamameds.com/# Safe access to generic ED medication

sildenafil generic price uk: how to get viagra prescription online – can you buy sildenafil over the counter in uk

SildenaPeak: SildenaPeak – SildenaPeak

cialis commercial bathtub oryginal cialis Tadalify

Safe access to generic ED medication: Safe access to generic ED medication – Kamagra reviews from US customers

sildenafil fast shipping: how much is the viagra pill – purchasing viagra in usa

viagra pharmacy generic: female viagra australia – SildenaPeak

cialis online overnight shipping: cialis how long – cialis online without pres

Compare Kamagra with branded alternatives Compare Kamagra with branded alternatives Fast-acting ED solution with discreet packaging

https://tadalify.com/# tadalafil tablets 20 mg global

tadalafil versus cialis: uses for cialis – cialis manufacturer

Non-prescription ED tablets discreetly shipped: Compare Kamagra with branded alternatives – ED treatment without doctor visits

Tadalify: does tadalafil lower blood pressure – Tadalify

Safe access to generic ED medication Men’s sexual health solutions online Non-prescription ED tablets discreetly shipped

SildenaPeak: SildenaPeak – how to buy viagra online safely

viagra 25 mg no prescription: SildenaPeak – sildenafil 20 mg coupon

https://sildenapeak.com/# SildenaPeak

Kamagra reviews from US customers: Compare Kamagra with branded alternatives – Men’s sexual health solutions online

SildenaPeak SildenaPeak how to get female viagra otc

how to buy generic viagra: viagra price pharmacy – sildenafil australia buy

Tadalify: vardenafil and tadalafil – cialis no perscription overnight delivery

SildenaPeak: SildenaPeak – SildenaPeak

buy tadalafil online paypal what is the generic for cialis Tadalify

Tadalify: cialis 5 mg for sale – cialis one a day

http://sildenapeak.com/# viagra 25 mg price

Men’s sexual health solutions online: Sildenafil oral jelly fast absorption effect – Fast-acting ED solution with discreet packaging

Sildenafil oral jelly fast absorption effect Kamagra reviews from US customers Non-prescription ED tablets discreetly shipped

SildenaPeak: best site to buy viagra – order viagra online without prescription

SildenaPeak: viagra australia over the counter – buy sildenafil in mexico

what is the active ingredient in cialis: Tadalify – cialis 30 day free trial

KamaMeds: Safe access to generic ED medication – KamaMeds

viagra canadian pharmacy generic viagra 200 SildenaPeak

buy cheap viagra uk: sildenafil 75 mg – generic viagra quick delivery

https://kamameds.shop/# Fast-acting ED solution with discreet packaging

can you purchase tadalafil in the us: Tadalify – cialis no prescription overnight delivery

generic viagra in india: SildenaPeak – SildenaPeak

female viagra nz: sildenafil 48 tabs – SildenaPeak

sildenafil 100mg from india SildenaPeak SildenaPeak

Affordable sildenafil citrate tablets for men: Affordable sildenafil citrate tablets for men – Kamagra oral jelly USA availability

Tadalify: buy tadalafil online paypal – Tadalify

average cost of viagra in canada: SildenaPeak – buy canadian sildenafil

https://kamameds.com/# ED treatment without doctor visits

Tadalify Tadalify Tadalify

Tadalify: when does tadalafil go generic – cialis 100mg review

can i take two 5mg cialis at once: cialis online delivery overnight – cialis free trial voucher

viagra tablet price in singapore: SildenaPeak – 200 mg viagra

purchase brand cialis cialis super active real online store Tadalify

cialis tubs: Tadalify – Tadalify

https://sildenapeak.shop/# india viagra generic

Men’s sexual health solutions online Kamagra oral jelly USA availability Kamagra reviews from US customers