Here is what you need to know on Thursday, May 25:

The US Dollar (USD) continued to gather strength against its major rivals on Thursday, and the USDollar Index traded at its strongest level since mid-March, above 104.00. In the second half of the day, the US Bureau of Economic Analysis will release the first revision to the first-quarter Gross Domestic Product (GDP) growth. The US economic docket will also feature April’s weekly Initial Jobless Claims and Pending Home Sales data.

The risk-averse market environment amid the uncertainty surrounding the outcome of the US debt-limit negotiations helped the USD outperform its rivals mid-week. US House Speaker Kevin McCarthy reassured on Wednesday that the US would avoid a default but noted that they still had a difference in overspending.

Hawkish comments from Fed Governor Christopher Waller, who said that he would not support stopping rate hikes unless there were clear evidence that inflation was moving down towards the 2% objective, provided an additional boost to the currency. In the late American session, the Fed’s May policy meeting minutes revealed that policymakers were split on the support for more interest rate increases. Still, this publication failed to trigger a noticeable market reaction.

Early Thursday, US stock index futures trade mixed, with the Dow Futures losing nearly 0.5% and the technology-heavy Nasdaq Futures adding more than 1%. Meanwhile, the benchmark 10-year US Treasury bond yield stays flat near 3.75% following Wednesday’s rally.

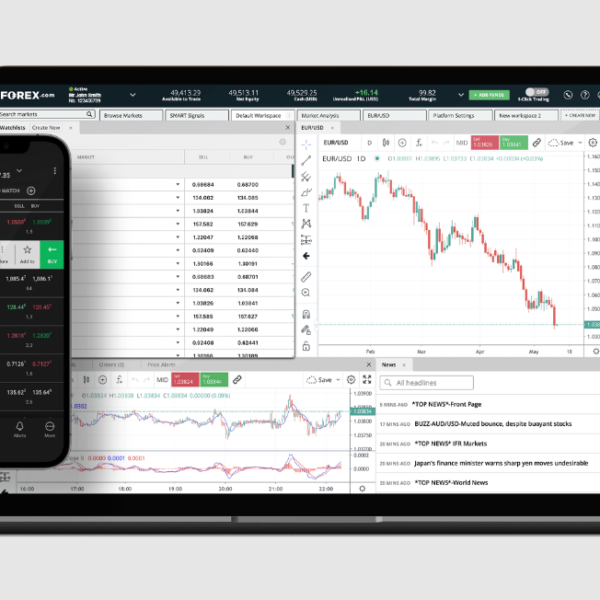

EUR/USD stays under persistent bearish pressure and trades at its lowest level over two months, below 1.0750 early Wednesday. Earlier in the day, the data from Germany revealed that the GDP contracted at an annualized rate of 0.5% in the first quarter, compared to the initial estimate of 0.1%.

Despite stronger-than-expected Consumer Price Index (CPI) figures, Pound Sterling failed to hold its ground against the USD, and GBP/USD registered its lowest daily close since late March below 1.2400 on Wednesday. The pair stays relatively quiet early Thursday, consolidating its weekly losses slightly above 1.2350.

Fuelled by rising US T-bond yields, USD/JPY advanced toward 140.00 and reached its highest since November. The pair stages a technical correction in the European morning and trades modestly lower on the day below 139.50.

Pressured by the broad USD strength and the decisive rebound in the benchmark 10-year US Treasury bond yield, Gold prices suffered significant losses on Wednesday. XAU/USD struggles to gain traction and trades at around $1,960 early Thursday.

Bitcoin fell more than 3% on Wednesday and continued to stretch lower in the Asian session on Thursday. After dropping below $26,000 earlier, however, BTC/USD erased a portion of its daily losses and was last seen trading near $26,200. Similarly, Ethereum fell 3% on Wednesday and broke below $1,800.