UK GDP preliminary data for Q4 2022 indicated a definite slowdown despite matching estimates. Monthly actual gross domestic product (GDP) is estimated to have fallen by 0.5% in December 2022 while the bigger picture showed that GDP was flat in the 3 months to the end of December 2022 as a whole 2022 GDP came in at 4.1%.

The services sector fell by 0.8% in December 2022, after unrevised growth of 0.2% in November 2022; the largest contributions to this fall came from human health activities, education, arts, entertainment and recreation activities, and transport and storage.

Output in consumer-facing services fell by 1.2% in December 2022 while production output grew by 0.3% in December 2022 compared to 0.1% in November. The main contributor to this growth was electricity, gas, steam, and air conditioning supply.

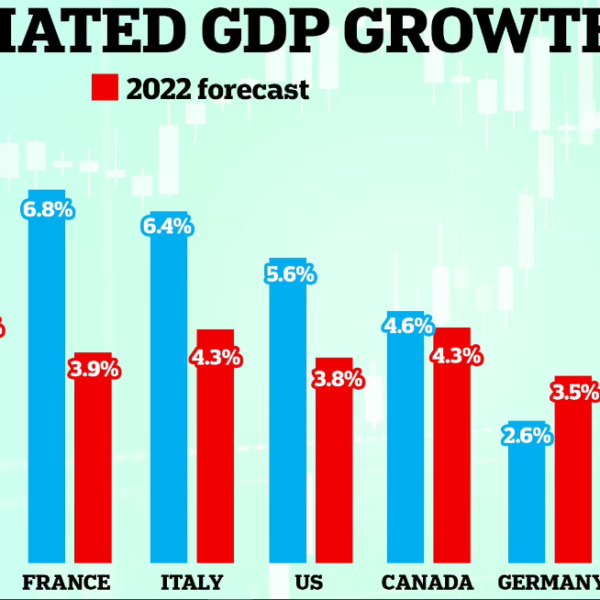

The International Monetary Fund (IMF) recently upgraded its global GDP Forecasts for 2023 with the UK economy growing at -0.6% for the year. This would represent a sharp downturn following a largely resilient 2022 with the UK economy facing significant headwinds in 2023. The ongoing worker’s strikes, Government debt, and ongoing issues around Brexit are all set to weigh on any attempted recovery in 2023.

The IMF emphasized that among its concerns for the UK economy moving forward is energy prices, employment levels, and monetary policy with further tightening expected to fight inflation. Energy prices have since fallen sharply adding a ray of hope, however, employment is yet to recover to pre-pandemic levels as the labor market remains tight but has not absorbed as many people back into employment as it had before. This is likely to result in less output and production in 2023.

The initial market reaction following the news has seen GBPUSD decline 15 pips. Looking at the bigger picture from a technical perspective, GBP/USD’s price has bounced off the 200-day MA following its selloff toward the end of last week. Yesterday we saw resistance come into play around the 50-day MA at 1.21920 with the price hovering between the two MAs.

The further downside remains more appealing over the medium term, however, a break above the 50-day MA and retest of the range or the psychological 1.2500 area cannot be ruled out before the next leg to the downside unfolds.