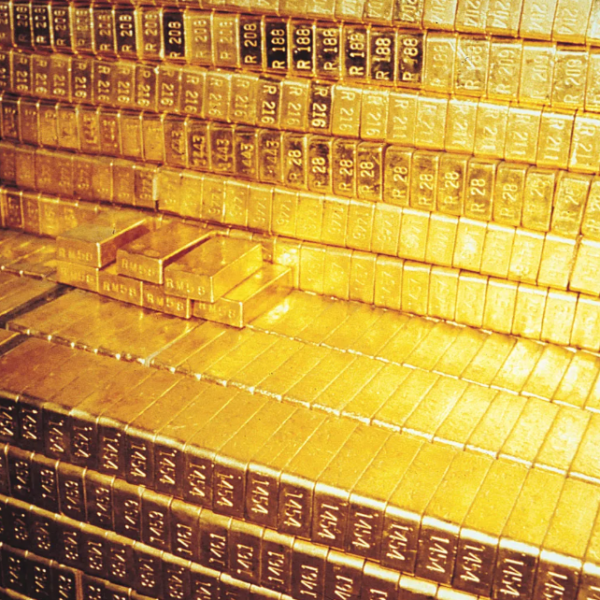

Gold appears to have taken an uplift, gaining support, to the joy of its traders. The price of gold currently stays above US$ 1710 so far today, while the US Dollar appears to have been held up on its upward move.

Despite the hawkish commentary from Federal Reserve Bank of Cleveland President Loretta Mester and Federal Reserve Vice Chair Lael Brainard, treasury yields soften.

The CAD has been steady after the overnight 75 basis point hike from the Bank of Canada overnight.

The Governor of the Reserve Bank of Australia, Phillip Lowe, hinted that future rate rises might not be as aggressive going forward. He said, “we recognize that all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises.”

The yield on the 3-year Australian Commonwealth Government (ACG) bond has dipped 16 basis points and the AUD sunk to a low of 0.6712 from 0.6745 prior.

Earlier today, Australian trade data missed forecasts, coming in at AUD 8.7 billion instead of the AUD 14.6 billion anticipated. Lower iron ore and other commodity prices appear to have taken their toll.

The Japanese Yen found some boost today after GDP data came in better than expected. The USD/JPY dipped below 144 after the final annual GDP printed at 3.5% to the end of July, exceeding expectations of 2.9% and 2.2%.

Crude oil has steadied in the Asian trading today after tumbling in the North American session. Data from the American Petroleum Institute (API) recorded 3.64 million barrels were added to storage last week.The WTI futures contract is near US$ 83 bbl while the Brent contract is approaching US$ 89 bbl.

The release of the US Energy Information Administration’s (EIA) weekly report will be watched closely later today.

Australia’s ASX 200 and Japan’s Nikkei 225 indices followed Wall Street’s lead higher today. Equity markets in China and Hong Kong’s are struggling to make positive ground due to ongoing lockdowns across large parts of the mainland.

The ECB prepares to raise rates by 75 basis points today. The EUR/USD has gained from the break in the dollar rise, currently at a touch below parity.

Later today, after ECB President Christine Lagarde’s Press conference, Fed Chair Powell will also be speaking.