The European Central Bank has raised interest rates by 50bps in line with expectations. The Central Bank expects to raise rates further, keeping them at sufficiently restrictive levels to ensure a timely return of inflation to its 2% medium-term target.

Inflation remains a sticking point, with the ECB confirming it intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March. It will then evaluate the subsequent path of its monetary policy. Future decisions will be data-dependent and follow a meeting-by-meeting approach.

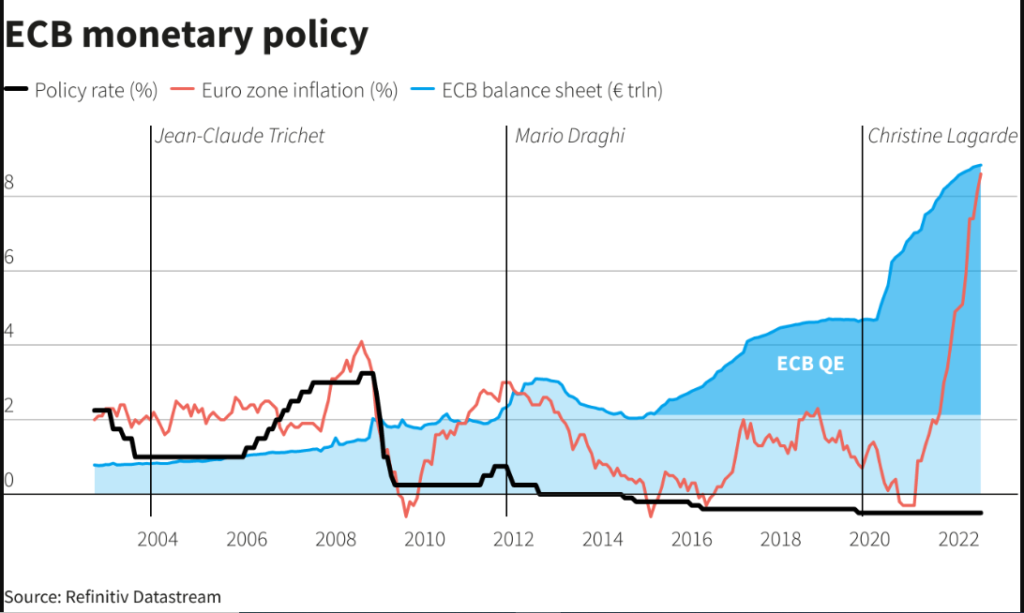

Furthermore, the central Bank confirmed the APP portfolio would decline at a measured and predictable pace, as the Eurosystem will not reinvest all of the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of June 2023, and its subsequent pace will be determined over time.

The ECB’s job is challenging, given the economic backdrop of the various countries in the Euro area. The Bank’s December projections saw inflation remaining at 3.4% in 2024 and 2.3% in 2025, above its target rate of 2%. Since the ECB’s December meeting, energy prices have taken a dive, which could see the ECB lower its inflation expectations. However, the Russia-Ukraine conflict remains uncertain, as evidenced by the IMF’s warning that the conflict still poses a significant risk to global recovery.

Looking ahead to the upcoming ECB Meetings and the rest of the year, inflation, particularly the core inflation data, is likely to be a driving force behind the ECB’s decisions. ECB policymakers have been hawkish heading into this meeting despite some positive signs. The ECBS Klaas Knot stated that he wants at least two more 50bps hikes (today’s meeting and the upcoming March meeting), which seems to be the plan given the policy statement.

EUR/USD initial reaction saw a 20 pip drop before trading flat ahead of the press conference. Having tapped the psychological 1.1000 level following yesterday’s FOMC meeting, there remains very little resistance to the 1.1200 level. The RSI is, however, in overbought territory on both the 4H and D timeframe, which could result in some pullback before continuing higher. We also show signs of rejection at the top of the ascending channel, which we have been trading within since mid-November.