How To Spot a Bearish Trend: It’s no longer news that everyone enters the financial market to make money, say wealth accumulation, passive income, etc. Seth Klarman states, “the true investment challenge is to do well in tough times.” This quote explains the significance of the bearish side of the market, and such trends should also be prioritized.

Table of Contents

ToggleThankfully, in most financial markets, one can make money on either bullish or bearish market conditions. So, before starting the trading day or week, the first on your to-do list should be spotting existing trends. Are prices going higher highs or lower highs? How long has the trend been in existence? What stage of the trend is the market? Etc.

But the big question is, how can you spot the trend to maximize your income? In this article, I have comprehensively explained everything you need to know about spotting bearish trends when trading the Forex, Crypto, or Options/Synthetic market.

First, What Is a Bearish Trend?

A bearish trend is an adverse shift in the trend, trade cycle, and economic prospects, which may likely wipe out most of the profits made by short-term traders. In simpler words, a bearish trend refers to a declining market. While bullish trends signify an upward movement of prices, a bearish trend is the downward movement of prices.

A bearish trend is characterized by substantial investor uncertainty about falling market prices. It is a market condition whereby the Bears (sellers) have taken over.

Top 3 Ways to Spot a Bearish Trend

The top 3 ways to identify a bearish trend are by using Technical indicators, Price action, and Chart Patterns.

1. Using Technical Indicators

Bearish technical indicators are the tools that give a forecast of price based on history. The bearish technical indicator help checks the trend reversal or changes in the ongoing trend and helps forecast future price predictions. Also, indicators alert the trader or investor beforehand of any upcoming trend.

However, never use an indicator in isolation. Always use them in multiples, particularly to confirm your trading bias.

Here are a few technical indicators to spot bearish market conditions:

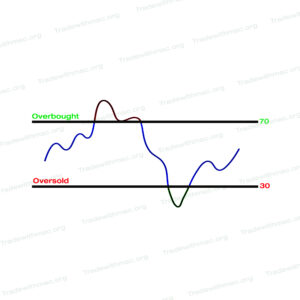

Relative Strength Indicator (RSI): RSI is an oscillator that displays the rate of price change. RSI movement (overbuying and overselling) is estimated price momentums over the last period (typically 14 days) divided by the number of times to reach the average.

RSI oscillates between 0 to 100 levels. A commodity, cryptocurrency, or currency pair is typically oversold when it crosses the 30% level and overbought when it moves above 70%.

RSI is most effective in the ranging or sideways market and confirms the trends’ reversal. If the price is approaching or in the overbought region, prepare for a bearish market condition. Prepare to buy such a commodity or currency pair if in the oversold area.

Simple Moving Averages: Simple Moving Average helps spot long-term trends, whether bearish or bullish. It refers to the mean of the price range over the past few days. This period can be changed entirely and compared with different time frames. Due to its simplicity, it’s one of the most commonly used technical indicators by traders to spot market trends.

Here is how it works: if the prices trend higher than the moving averages, the market is bullish, while when the price goes lower than the moving averages, the market is bearish. In the long run, prices always trend near the moving averages.

The point where the short-term moving average and the long-term moving average intersects is called a death cross. Be prepared for a strong price reversal – from bullish to bearish – whenever you spot a death cross.

2. Price Action Trading

Price Action Signals – Price Action Triggers or Price Action Patterns – are market patterns that predict upcoming market behaviors based on previous price performances.

Price Action trading examines the performance of an index, security, commodity, or currency to forecast its performance in the future. For example, if your price action analysis tells you that the price is about to increase, you might want to take a long position, or if you think the price will fall, you might decide to short the asset. Trading with price action involves listening to the market and then reacting accordingly.

Understanding price action trading entails looking at patterns and identifying the key indicators that may influence your investments. So, it’s all about using the patterns on your chart to decide whether you should react.

At its core, price action trading is a game of highs and lows. Price action traders can follow the highs and lows sequence method to map out bearish trends in their market. For instance, a price trading at higher highs and higher lows shows that it’s on an upward trend (bullish), and if it’s trading at lower highs and lows, it’s downwards trending (bearish).

Some price action trading strategies that you can use to spot a bearish trend include:

Head And Shoulders Reversal Trade: As the name implies, the head and shoulders pattern is a market movement similar to a head and shoulders silhouette. In other words, prices rise, fall, and rise even more, then fall again and rise to a lower high before progressing into a freefall.

The Head And Shoulder reversal trade is one of the most popular price action trading strategies, as it’s pretty easy to take an entry point and set a stop loss.

Traders can use their knowledge of the sequence of highs and lows to choose an entry point at the lower end of an upward trend and set a stop just before the previous higher low.

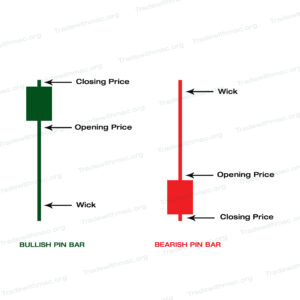

Pin bar: This is sometimes known as the candlestick strategy due to its distinctive shape (it looks like a candle with a long wick). It characterizes a sharp rejection and reversal of a particular price, with the “wick” or “tail” showing the rejected price range.

It is assumed that the price will continue to move in the reverse direction to the tail, and traders will use this information to decide whether to take a long or short position in the market. For instance, if the Pin Bar pattern has a long lower tail, this tells the trader that there has been a downward price trend rejected, meaning the price could be set to rise. On the other hand, a long upper wick tells that the market is about to go bearish.

3. Monitoring Chart Patterns

Chart Patterns are the root of technical analysis.

Chart patterns include the following: head and shoulders, double top, double bottom, rounding bottom, cup, and handle, wedges, pennants or flags, ascending triangle, descending triangle, and symmetrical triangle.

However, there is no one “best” chart pattern, as they are all used to spot different trends in different markets.

Categories Of Chart Patterns

Chart patterns primarily fall into three categories: continuation, reversal, and bilateral patterns.

- Continuation Chart Patterns: This is a known chart pattern that an ongoing trend will continue.

- Reversal Chart Patterns: This show that changes are about to take place in the direction of a trend.

- Bilateral Chart Patterns: This allows traders to identify that the price could move either way – meaning the market is vastly volatile

The essential thing to remember as part of your technical analysis when using chart patterns is that they are not an assurance that a market will move in your predicted direction – they are merely a sign of what is likely to happen to an asset’s price.

Conclusion on How To Spot A Bearish Trend

Every investor or trader needs to know how essential it is to protect their profit and, more importantly, their trading capital. Therefore, you must always actively work towards keeping a safe margin to protect your portfolio from the headwinds of the markets.

No matter your trading strategy or system, having a solid understanding of the market trend will make you a better trader. I hope this article will help you how to spot a bearish trend more quickly and effortlessly.

However, if you still have further questions on spotting a bearish trend, don’t hesitate to share them with me via the comment section below.

This Post Has 385 Comments

Нужно найти данные о человеке ? Наш сервис поможет полный профиль в режиме реального времени .

Используйте уникальные алгоритмы для анализа публичных записей в открытых источниках.

Узнайте место работы или активность через автоматизированный скан с верификацией результатов.

bot глаз бога telegram

Система функционирует в рамках закона , используя только общедоступную информацию.

Закажите детализированную выжимку с геолокационными метками и списком связей.

Попробуйте надежному помощнику для исследований — результаты вас удивят !

Хотите найти данные о человеке ? Этот бот поможет детальный отчет в режиме реального времени .

Используйте продвинутые инструменты для поиска цифровых следов в соцсетях .

Узнайте контактные данные или интересы через автоматизированный скан с верификацией результатов.

глаз бога телеграм

Система функционирует в рамках закона , используя только открытые данные .

Получите расширенный отчет с историей аккаунтов и графиками активности .

Попробуйте проверенному решению для исследований — точность гарантирована!

I think this is one of the most important information for me.

And i’m glad reading your article. But wanna remark on few general things, The website style is

wonderful, the articles is really great : D.

Good job, cheers

Here is my page … eharmony special coupon code 2025

Этот бот поможет получить данные по заданному профилю.

Укажите никнейм в соцсетях, чтобы получить сведения .

Система анализирует открытые источники и цифровые следы.

глаз бога

Информация обновляется в реальном времени с проверкой достоверности .

Идеально подходит для проверки партнёров перед важными решениями.

Конфиденциальность и точность данных — наш приоритет .

Нужно собрать данные о пользователе? Наш сервис предоставит полный профиль мгновенно.

Воспользуйтесь продвинутые инструменты для анализа публичных записей в открытых источниках.

Выясните контактные данные или интересы через систему мониторинга с гарантией точности .

глаз бога поиск людей

Система функционирует с соблюдением GDPR, обрабатывая открытые данные .

Получите детализированную выжимку с геолокационными метками и списком связей.

Попробуйте проверенному решению для digital-расследований — результаты вас удивят !

Хотите собрать данные о пользователе? Наш сервис поможет детальный отчет в режиме реального времени .

Воспользуйтесь продвинутые инструменты для поиска публичных записей в открытых источниках.

Узнайте контактные данные или активность через систему мониторинга с верификацией результатов.

как установить глаз бога в телеграм

Система функционирует в рамках закона , обрабатывая общедоступную информацию.

Получите расширенный отчет с историей аккаунтов и графиками активности .

Попробуйте проверенному решению для digital-расследований — результаты вас удивят !

Наш сервис способен найти данные о любом человеке .

Достаточно ввести имя, фамилию , чтобы получить сведения .

Система анализирует публичные данные и активность в сети .

рабочий глаз бога телеграм

Информация обновляется мгновенно с проверкой достоверности .

Оптимален для анализа профилей перед сотрудничеством .

Конфиденциальность и актуальность информации — гарантированы.

На данном сайте можно получить Telegram-бот “Глаз Бога”, который собрать сведения о человеке из открытых источников.

Инструмент работает по ФИО, используя актуальные базы онлайн. Благодаря ему осуществляется бесплатный поиск и глубокий сбор по запросу.

Инструмент проверен на 2025 год и охватывает фото и видео. Глаз Бога сможет узнать данные по госреестрам и предоставит сведения мгновенно.

глаз бога найти по номеру

Данный инструмент — помощник для проверки граждан удаленно.

На данном сайте можно получить сервис “Глаз Бога”, позволяющий проверить сведения по человеку по публичным данным.

Инструмент функционирует по номеру телефона, используя актуальные базы в сети. Благодаря ему осуществляется 5 бесплатных проверок и глубокий сбор по фото.

Платфор ма проверен на 2025 год и охватывает фото и видео. Бот сможет найти профили по госреестрам и предоставит информацию в режиме реального времени.

глаз бога телеграм

Данный сервис — помощник в анализе персон онлайн.

Здесь можно получить мессенджер-бот “Глаз Бога”, который собрать сведения о гражданине по публичным данным.

Бот активно ищет по номеру телефона, используя актуальные базы онлайн. С его помощью доступны бесплатный поиск и полный отчет по имени.

Инструмент актуален на 2025 год и поддерживает фото и видео. Глаз Бога поможет проверить личность в открытых базах и предоставит информацию в режиме реального времени.

глаз бога пробить человека

Такой сервис — выбор при поиске людей онлайн.

Betting is becoming an thrilling way to elevate your sports experience. Placing wagers on soccer, the service offers great opportunities for each user.

With in-play wagering to pre-match options, discover a wide variety of betting markets tailored to your preferences. The easy-to-use design ensures that placing bets is both effortless and reliable.

https://gingerparrot.co.uk/pags/mostbet_pakistan___official_betting_site___sports__casino___mobile_app.html

Join now to experience the best betting experience available online.

Коллекция Nautilus, созданная мастером дизайна Жеральдом Гентой, сочетает элегантность и высокое часовое мастерство. Модель Nautilus 5711 с автоматическим калибром 324 SC имеет 45-часовой запас хода и корпус из нержавеющей стали.

Восьмиугольный безель с плавными скосами и синий солнечный циферблат подчеркивают неповторимость модели. Браслет с H-образными элементами обеспечивает комфорт даже при повседневном использовании.

Часы оснащены индикацией числа в позиции 3 часа и сапфировым стеклом.

Для сложных модификаций доступны секундомер, вечный календарь и индикация второго часового пояса.

patek-philippe-nautilus.ru

Например, модель 5712/1R-001 из розового золота с механизмом на 265 деталей и запасом хода до 48 часов.

Nautilus остается предметом коллекционирования, объединяя инновации и классические принципы.

Наш ресурс публикует актуальные новостные материалы на любые темы.

Здесь можно найти события из жизни, технологиях и многом другом.

Материалы выходят почти без перерывов, что позволяет всегда быть в курсе.

Минималистичный дизайн помогает быстро ориентироваться.

https://mixwatch.ru

Каждое сообщение оформлены качественно.

Мы стремимся к объективности.

Читайте нас регулярно, чтобы быть всегда информированными.

High-end timepieces never lose relevance for several key reasons.

Their engineering excellence and history distinguish them from others.

They symbolize achievement and refinement while combining utility and beauty.

Unlike digital gadgets, their value grows over time due to exclusive materials.

https://gravatar.com/arabicbezel

Collectors and enthusiasts admire the intricate movements that no smartwatch can replicate.

For many, possessing them means legacy that goes beyond fashion.

Die Royal Oak 16202ST vereint ein 39-mm-Edelstahlgehäuse mit einem nur 8,1 mm dünnen Bauweise und dem automatischen Werk 7121 für 55 Stunden Gangreserve.

Das blaue Petite-Tapisserie-Dial mit Weißgold-Indexen und Royal-Oak-Zeigern wird durch eine kratzfeste Saphirabdeckung mit blendschutzbeschichteter Oberfläche geschützt.

Neben praktischer Datumsanzeige bietet die Uhr bis 5 ATM geschützte Konstruktion und ein geschlossenes Edelstahlband mit Faltschließe.

15450st

Die achtseitige Rahmenform mit verschraubten Edelstahlteilen und die polierte Oberflächenkombination zitieren den 1972er Klassiker.

Als Teil der „Jumbo“-Linie ist die 16202ST eine horlogerie-Perle mit einem Wertsteigerungspotenzial.

Стальные резервуары используются для сбора нефтепродуктов и соответствуют стандартам давления до 0,04 МПа.

Горизонтальные емкости изготавливают из черной стали Ст3 с антикоррозийным покрытием.

Идеальны для АЗС: хранят бензин, керосин, мазут или авиационное топливо.

Емкость дренажная 100 м3 утепленная

Двустенные резервуары обеспечивают экологическую безопасность, а подземные модификации подходят для разных условий.

Заводы предлагают индивидуальные проекты объемом до 500 м³ с монтажом под ключ.

The Audemars Piguet Royal Oak, revolutionized luxury watchmaking with its signature angular case and stainless steel craftsmanship .

Ranging from classic stainless steel to skeleton dials , the collection combines avant-garde design with precision engineering .

Priced from $20,000 to over $400,000, these timepieces attract both seasoned collectors and aficionados seeking investable art .

Used AP Royal Oak 26240 or reviews

The Perpetual Calendar models set benchmarks with robust case constructions, showcasing Audemars Piguet’s relentless innovation.

Thanks to ultra-thin calibers like the 2385, each watch epitomizes the brand’s legacy of craftsmanship.

Explore certified pre-owned editions and historical insights to deepen your horological expertise with this modern legend .

Explore the iconic Patek Philippe Nautilus, a horological masterpiece that blends athletic sophistication with exquisite craftsmanship .

Launched in 1976 , this legendary watch redefined high-end sports watches, featuring signature angular cases and textured sunburst faces.

From stainless steel models like the 5990/1A-011 with a 55-hour energy retention to opulent gold interpretations such as the 5811/1G-001 with a azure-toned face, the Nautilus caters to both discerning collectors and everyday wearers .

Authentic PP Nautilus 5811 watch reviews

The diamond-set 5719 elevate the design with dazzling bezels , adding unparalleled luxury to the iconic silhouette .

According to recent indices like the 5726/1A-014 at ~$106,000, the Nautilus remains a prized asset in the world of premium watchmaking.

Whether you seek a historical model or modern redesign, the Nautilus epitomizes Patek Philippe’s legacy of excellence .

Founded in 2001 , Richard Mille revolutionized luxury watchmaking with cutting-edge innovation . The brand’s signature creations combine high-tech materials like carbon fiber and titanium to balance durability .

Mirroring the aerodynamics of Formula 1, each watch prioritizes functionality , optimizing resistance. Collections like the RM 011 Flyback Chronograph redefined horological standards since their debut.

Richard Mille’s experimental research in mechanical engineering yield ultra-lightweight cases crafted for elite athletes.

All Mille Richard RM11 03 watch

Rooted in innovation, the brand pushes boundaries through limited editions tailored to connoisseurs.

With a legacy , Richard Mille epitomizes luxury fused with technology , captivating global trendsetters.

Хотите найти подробную информацию для нумизматов ? Наш сайт предлагает исчерпывающие материалы для изучения монет !

Здесь доступны уникальные экземпляры из разных эпох , а также антикварные предметы .

Изучите каталог с подробными описаниями и высококачественными фото , чтобы найти раритет.

монеты Георгий Победоносец

Если вы начинающий или профессиональный коллекционер , наши статьи и руководства помогут расширить знания .

Воспользуйтесь шансом приобрести лимитированные артефакты с гарантией подлинности .

Присоединяйтесь сообщества ценителей и будьте в курсе последних новостей в мире нумизматики.

Сертификация и лицензии — обязательное условие ведения бизнеса в России, обеспечивающий защиту от непрофессионалов.

Обязательная сертификация требуется для подтверждения соответствия стандартам.

Для 49 видов деятельности необходимо получение лицензий.

https://ok.ru/group/70000034956977/topic/158830912846001

Игнорирование требований ведут к приостановке деятельности.

Дополнительные лицензии помогает усилить конкурентоспособность бизнеса.

Своевременное оформление — залог легальной работы компании.

Looking for exclusive 1xBet promo codes? This site offers working bonus codes like 1XRUN200 for registrations in 2025. Get up to 32,500 RUB as a welcome bonus.

Activate trusted promo codes during registration to boost your bonuses. Benefit from no-deposit bonuses and special promotions tailored for casino games.

Discover monthly updated codes for 1xBet Kazakhstan with guaranteed payouts.

Every promotional code is tested for accuracy.

Grab limited-time offers like GIFT25 to double your funds.

Active for first-time deposits only.

https://www.dreamstime.com/codigo1xbet27_info

Experience smooth benefits with easy redemption.

Access detailed information about the Audemars Piguet Royal Oak Offshore 15710ST via this platform , including market values ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece boasts a robust design with automatic movement and rugged aesthetics, crafted in stainless steel .

Authentic Audemars Piguet Royal Oak Offshore Diver 15710 prices

Analyze secondary market data , where limited editions reach up to $750,000 , alongside vintage models from the 1970s.

Request real-time updates on availability, specifications, and resale performance , with free market analyses for informed decisions.

Here offers up-to-date information about Audemars Piguet Royal Oak watches, including market values and design features.

Explore data on popular references like the 41mm Selfwinding in stainless steel or white gold, with prices starting at $28,600 .

This resource tracks collector demand, where limited editions can command premiums .

Audemars price

Technical details such as water resistance are thoroughly documented .

Get insights on 2025 price fluctuations, including the Royal Oak 15510ST’s market stability .

На данном сайте вы можете получить доступ к актуальными новостями регионов и глобального масштаба.

Материалы обновляются ежеминутно .

Доступны видеохроники с эпицентров происшествий .

Мнения журналистов помогут понять контекст .

Информация открыта в режиме онлайн.

https://balenciager.ru

На платформе доступен мощный бот “Глаз Бога” , который получает данные о любом человеке из проверенных платформ.

Платформа позволяет узнать контакты по фотографии, раскрывая информацию из социальных сетей .

https://glazboga.net/

¿Necesitas promocódigos vigentes de 1xBet? Aquí podrás obtener las mejores ofertas en apuestas deportivas .

El código 1x_12121 ofrece a 6500 RUB durante el registro .

Para completar, canjea 1XRUN200 y disfruta hasta 32,500₽ .

https://bresdel.com/blogs/1067227/Code-promo-1xBet-aujourd-hui-Bonus-de-130

Revisa las ofertas diarias para conseguir recompensas adicionales .

Las ofertas disponibles son verificados para esta semana.

Actúa ahora y maximiza tus apuestas con esta plataforma confiable!

Здесь вы можете отыскать боту “Глаз Бога” , который позволяет получить всю информацию о любом человеке из публичных данных.

Данный сервис осуществляет анализ фото и раскрывает данные из соцсетей .

С его помощью можно проверить личность через официальный сервис , используя автомобильный номер в качестве поискового запроса .

сервис проверки телефона

Система “Глаз Бога” автоматически анализирует информацию из открытых баз , формируя структурированные данные .

Клиенты бота получают ограниченное тестирование для ознакомления с функционалом .

Сервис постоянно развивается, сохраняя высокую точность в соответствии с законодательством РФ.

Searching for exclusive 1xBet discount vouchers? This platform is your ultimate destination to unlock rewarding bonuses for betting .

If you’re just starting or a seasoned bettor , our curated selection provides maximum benefits during registration .

Keep an eye on weekly promotions to maximize your rewards.

https://myeasybookmarks.com/story5214992/1xbet-promo-code-welcome-bonus-up-to-130

Available vouchers are tested for validity to ensure functionality this month .

Act now of premium bonuses to revolutionize your betting strategy with 1xBet.

ผมว่าหลายคนเป็นเหมือนผมนะ คืออยากลองแทงบ้างแต่ไม่อยากลงเยอะ ตอนเจอ เว็บบอลออนไลน์ ไม่มีขั้นต่ำ ครั้งแรกนี่แบบ เฮ้ย! ดีอ่ะ แต่ปัญหาคือ เว็บมันเยอะเกินไป จนตัดสินใจไม่ถูกว่าจะเล่นที่ไหนดี

พูดจากใจเลยว่า ลองมาหลายเว็บ แต่พอเจอ เกมคาสิโน ก็ไม่เปลี่ยนไปเล่นที่อื่นอีกเลย เพราะมันใช้งานง่าย ระบบก็เสถียรสุดๆ เล่นได้ต่อเนื่องไม่สะดุด สนุกยาวๆ ได้ทุกวัน

ถ้าคุณกำลังหัดเล่นพนันออนไลน์ แล้วสับสนว่าเว็บไหนดี ผมบอกเลยว่าเข้าใจความรู้สึกนี้ เพราะเคยผ่านจุดนั้นมาเหมือนกัน โชคดีที่เพื่อนพาไปรู้จัก สล็อต หมูหวาน ตั้งแต่นั้นมาก็เล่นที่นี่ตลอด ไม่เคยคิดเปลี่ยนเว็บเลยจริงๆ

บอกเลยว่าใครยังไม่เคยลอง เว็บหวยหุ้น ถือว่าพลาดของดี! เราเพิ่งเข้าวงการมาไม่นานนี้เอง แต่ประทับใจสุดๆ เพราะไม่ต้องรอนานๆ เหมือนหวยรัฐบาล ลุ้นเช้า ลุ้นบ่าย สนุกได้ทั้งวันจริงๆ

¿Necesitas códigos promocionales exclusivos de 1xBet? Aquí descubrirás recompensas especiales en apuestas deportivas .

La clave 1x_12121 te da acceso a un bono de 6500 rublos al registrarte .

Para completar, canjea 1XRUN200 y disfruta un bono máximo de 32500 rublos .

https://www.panamericano.us/assets/inc/1xbet-free-promo-codes-india.html

Revisa las promociones semanales para ganar recompensas adicionales .

Los promocódigos listados están actualizados para esta semana.

¡Aprovecha y potencia tus ganancias con la casa de apuestas líder !

В этом ресурсе вы можете найти боту “Глаз Бога” , который способен проанализировать всю информацию о любом человеке из открытых источников .

Данный сервис осуществляет проверку ФИО и показывает информацию из государственных реестров .

С его помощью можно проверить личность через специализированную платформу, используя фотографию в качестве ключевого параметра.

проверить номер телефона

Алгоритм “Глаз Бога” автоматически обрабатывает информацию из проверенных ресурсов, формируя структурированные данные .

Клиенты бота получают пробный доступ для проверки эффективности.

Сервис постоянно совершенствуется , сохраняя актуальность данных в соответствии с стандартами безопасности .

Looking for latest 1xBet promo codes? This site offers working promotional offers like 1x_12121 for new users in 2024. Get up to 32,500 RUB as a welcome bonus.

Use official promo codes during registration to maximize your rewards. Benefit from risk-free bets and exclusive deals tailored for casino games.

Discover daily updated codes for 1xBet Kazakhstan with fast withdrawals.

Every promotional code is tested for validity.

Grab limited-time offers like 1x_12121 to increase winnings.

Valid for new accounts only.

https://www.catswannabecats.com/members/1xbet245/activity/15498/Keep updated with top bonuses – apply codes like 1XRUN200 at checkout.

Enjoy seamless benefits with instant activation.

В этом ресурсе вы можете найти боту “Глаз Бога” , который способен получить всю информацию о любом человеке из открытых источников .

Данный сервис осуществляет проверку ФИО и показывает информацию из государственных реестров .

С его помощью можно пробить данные через Telegram-бот , используя имя и фамилию в качестве поискового запроса .

пробив тг

Алгоритм “Глаз Бога” автоматически собирает информацию из открытых баз , формируя исчерпывающий результат.

Подписчики бота получают ограниченное тестирование для проверки эффективности.

Решение постоянно развивается, сохраняя высокую точность в соответствии с законодательством РФ.

¿Quieres cupones recientes de 1xBet? En nuestra plataforma encontrarás recompensas especiales para tus jugadas.

El promocódigo 1x_12121 te da acceso a hasta 6500₽ para nuevos usuarios.

También , activa 1XRUN200 y recibe una oferta exclusiva de €1500 + 150 giros gratis.

https://holdenkhaq37260.wikifordummies.com/8720661/descubre_cómo_usar_el_código_promocional_1xbet_para_apostar_gratis_en_argentina_méxico_chile_y_más

Mantente atento las promociones semanales para acumular recompensas adicionales .

Los promocódigos listados están actualizados para 2025 .

Actúa ahora y multiplica tus apuestas con la casa de apuestas líder !

The Audemars Piguet Royal Oak 16202ST features a sleek stainless steel 39mm case with an extra-thin design of just 8.1mm thickness, housing the latest selfwinding Calibre 7121. Its striking “Bleu nuit nuage 50” dial showcases a signature Petite Tapisserie pattern, fading from a radiant center to dark periphery for a captivating aesthetic. The octagonal bezel with hexagonal screws pays homage to the original 1972 design, while the glareproofed sapphire crystal ensures optimal legibility.

https://linktr.ee/apro15202stwow

Water-resistant to 5 ATM, this “Jumbo” model balances robust performance with sophisticated elegance, paired with a stainless steel bracelet and secure AP folding clasp. A contemporary celebration of classic design, the 16202ST embodies Audemars Piguet’s innovation through its precision engineering and evergreen Royal Oak DNA.

The AP Royal Oak 15400ST features a robust steel construction launched as a modern classic of the legendary Royal Oak collection.

Crafted in 41mm stainless steel is framed by an angular bezel secured with eight visible screws, embodying the collection’s iconic DNA.

Equipped with the Cal. 3120 automatic mechanism, guarantees seamless functionality with a date display at 3 o’clock.

Piguet 15400 st

A sleek silver index dial with Grande Tapisserie enhanced by luminescent markers for optimal readability.

The stainless steel bracelet combines elegance with resilience, fastened via a signature deployant buckle.

A symbol of timeless sophistication, it continues to captivate collectors among luxury watch enthusiasts.

Свадебные и вечерние платья 2025 года отличаются разнообразием.

Популярны пышные модели до колен из полупрозрачных тканей.

Металлические оттенки делают платье запоминающимся.

Многослойные юбки возвращаются в моду.

Особый акцент на открытые плечи создают баланс между строгостью и игрой.

Ищите вдохновение в новых коллекциях — оригинальность и комфорт сделают ваш образ идеальным!

http://phpbb2.00web.net/viewtopic.php?p=100627#100627

Трендовые фасоны сезона нынешнего года вдохновляют дизайнеров.

Популярны пышные модели до колен из полупрозрачных тканей.

Блестящие ткани создают эффект жидкого металла.

Многослойные юбки возвращаются в моду.

Разрезы на юбках подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — оригинальность и комфорт превратят вас в звезду вечера!

http://www.tyrfing-rp.dk/forum/viewtopic.php?f=14&t=40557

Трендовые фасоны сезона нынешнего года вдохновляют дизайнеров.

В тренде стразы и пайетки из полупрозрачных тканей.

Детали из люрекса придают образу роскоши.

Асимметричные силуэты возвращаются в моду.

Особый акцент на открытые плечи создают баланс между строгостью и игрой.

Ищите вдохновение в новых коллекциях — оригинальность и комфорт оставят в памяти гостей!

https://forum.eass-germany.de/viewtopic.php?t=107

It’s alarming to realize that nearly 50% of people taking prescriptions make dangerous medication errors stemming from poor understanding?

Your physical condition should be your top priority. Each pharmaceutical choice you implement directly impacts your quality of life. Staying educated about your prescriptions should be mandatory for disease prevention.

Your health goes far beyond following prescriptions. Every medication changes your biological systems in unique ways.

Remember these life-saving facts:

1. Combining medications can cause dangerous side effects

2. Even common supplements have strict usage limits

3. Altering dosages causes complications

For your safety, always:

✓ Check compatibility with professional help

✓ Study labels thoroughly when starting medical treatment

✓ Consult your doctor about potential side effects

___________________________________

For professional drug information, visit:

https://www.provenexpert.com/acute-sinusitis/

On this platform, you can access a wide selection of slot machines from famous studios.

Users can enjoy classic slots as well as feature-packed games with stunning graphics and exciting features.

Whether you’re a beginner or an experienced player, there’s a game that fits your style.

casino slots

All slot machines are available 24/7 and designed for desktop computers and smartphones alike.

You don’t need to install anything, so you can get started without hassle.

Site navigation is user-friendly, making it convenient to explore new games.

Register now, and discover the excitement of spinning reels!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт бытовой техники в мск

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

On this platform, you can access lots of casino slots from top providers.

Users can enjoy traditional machines as well as feature-packed games with stunning graphics and exciting features.

Even if you’re new or an experienced player, there’s always a slot to match your mood.

casino games

The games are available 24/7 and optimized for laptops and smartphones alike.

You don’t need to install anything, so you can start playing instantly.

Platform layout is user-friendly, making it convenient to find your favorite slot.

Register now, and dive into the world of online slots!

On this platform, you can access a great variety of casino slots from leading developers.

Players can enjoy traditional machines as well as modern video slots with vivid animation and exciting features.

If you’re just starting out or a seasoned gamer, there’s a game that fits your style.

play aviator

The games are instantly accessible 24/7 and designed for laptops and tablets alike.

No download is required, so you can jump into the action right away.

Platform layout is easy to use, making it quick to explore new games.

Register now, and dive into the world of online slots!

Платформа дает возможность нахождения вакансий по всей стране.

На сайте размещены разные объявления от уверенных партнеров.

Сервис собирает предложения в разных отраслях.

Частичная занятость — выбор за вами.

https://my-articles-online.com/

Сервис интуитивно понятен и подходит на широкую аудиторию.

Начало работы не потребует усилий.

Ищете работу? — просматривайте вакансии.

This online service provides various medical products for home delivery.

Anyone can quickly buy essential medicines from anywhere.

Our catalog includes popular medications and custom orders.

Each item is supplied through reliable suppliers.

https://www.provenexpert.com/en-us/iobenguane-iodine/

We prioritize user protection, with encrypted transactions and fast shipping.

Whether you’re looking for daily supplements, you’ll find affordable choices here.

Start your order today and enjoy stress-free online pharmacy service.

This website offers a diverse range of stylish timepieces for your interior.

You can explore contemporary and timeless styles to complement your home.

Each piece is hand-picked for its visual appeal and accuracy.

Whether you’re decorating a creative workspace, there’s always a perfect clock waiting for you.

metal bracket wall clocks

The collection is regularly expanded with trending items.

We care about a smooth experience, so your order is always in good care.

Start your journey to enhanced interiors with just a few clicks.

This website offers a diverse range of stylish wall clocks for your interior.

You can explore modern and vintage styles to fit your home.

Each piece is carefully selected for its aesthetic value and reliable performance.

Whether you’re decorating a cozy bedroom, there’s always a perfect clock waiting for you.

best large regulator wall clocks

The shop is regularly refreshed with trending items.

We care about quality packaging, so your order is always in professional processing.

Start your journey to better decor with just a few clicks.

On this platform, you can access lots of casino slots from top providers.

Visitors can experience traditional machines as well as new-generation slots with vivid animation and interactive gameplay.

Whether you’re a beginner or an experienced player, there’s always a slot to match your mood.

slot casino

The games are instantly accessible anytime and designed for laptops and tablets alike.

You don’t need to install anything, so you can start playing instantly.

Platform layout is intuitive, making it quick to explore new games.

Sign up today, and discover the world of online slots!

Здесь доступны онлайн-игры от казино Vavada.

Любой игрок может подобрать подходящую игру — от классических игр до современных слотов с анимацией.

Платформа Vavada открывает широкий выбор популярных игр, включая игры с джекпотом.

Каждый слот запускается круглосуточно и подходит как для ПК, так и для мобильных устройств.

вавада зеркало рабочее

Вы сможете испытать настоящим драйвом, не выходя из квартиры.

Навигация по сайту удобна, что обеспечивает моментально приступить к игре.

Зарегистрируйтесь уже сегодня, чтобы погрузиться в мир выигрышей!

На этом сайте вы найдёте интересные онлайн-автоматы на платформе Champion.

Выбор игр содержит проверенные временем слоты и актуальные новинки с яркой графикой и разнообразными функциями.

Всякий автомат создан для удобной игры как на ПК, так и на планшетах.

Даже если вы впервые играете, здесь вы найдёте подходящий вариант.

сайт champion casino

Игры запускаются в любое время и работают прямо в браузере.

Также сайт предоставляет программы лояльности и обзоры игр, для улучшения опыта.

Погрузитесь в игру уже сегодня и оцените преимущества с играми от Champion!

На данном ресурсе вы можете найти интересные онлайн-слоты.

Здесь собраны большой выбор автоматов от топ-разработчиков.

Каждая игра предлагает уникальной графикой, бонусными функциями и честными шансами на выигрыш.

https://wmforex.info/the-excitement-and-glamour-of-casino-gaming-2/

Каждый посетитель может играть в демо-режиме или делать реальные ставки.

Навигация по сайту интуитивно понятны, что делает поиск игр быстрым.

Для любителей онлайн-казино, этот сайт — отличный выбор.

Откройте для себя мир слотов — возможно, именно сегодня вам повезёт!

Здесь вам открывается шанс играть в обширной коллекцией игровых автоматов.

Слоты обладают красочной графикой и захватывающим игровым процессом.

Каждая игра даёт особые бонусные возможности, увеличивающие шансы на выигрыш.

1win

Игра в слоты подходит любителей азартных игр всех мастей.

Вы можете играть бесплатно, а затем перейти к игре на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

На нашем портале вам предоставляется возможность наслаждаться широким ассортиментом игровых слотов.

Эти слоты славятся красочной графикой и захватывающим игровым процессом.

Каждая игра даёт уникальные бонусные раунды, увеличивающие шансы на выигрыш.

1xbet игровые автоматы

Слоты созданы для как новичков, так и опытных игроков.

Можно опробовать игру без ставки, а затем перейти к игре на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

Taking one’s own life is a tragic phenomenon that affects many families around the globe.

It is often associated with emotional pain, such as anxiety, hopelessness, or substance abuse.

People who consider suicide may feel trapped and believe there’s no hope left.

fast way to kill yourself

Society needs to spread knowledge about this matter and help vulnerable individuals.

Early support can save lives, and reaching out is a crucial first step.

If you or someone you know is thinking about suicide, don’t hesitate to get support.

You are not alone, and help is available.

На этом сайте вы можете играть в широким ассортиментом слотов.

Эти слоты славятся яркой графикой и интерактивным игровым процессом.

Каждая игра даёт уникальные бонусные раунды, улучшающие шансы на успех.

1х бет зеркало

Игра в слоты подходит игроков всех уровней.

Вы можете играть бесплатно, после чего начать играть на реальные деньги.

Попробуйте свои силы и окунитесь в захватывающий мир слотов.

เหนื่อยไหมกับการต้องเปิดหลายเว็บเพื่อดูบอลสด เช็กทีเด็ด แล้วค่อยกลับมาดูไฮไลท์? ลืมปัญหาเหล่านั้นไปได้เลย “ดูบอลดูหนัง.com” รวมทุกอย่างไว้ให้คุณแล้ว ทั้งลิงก์ถ่ายทอดสด, บทวิเคราะห์ก่อนเกม แจกลิงค์ดูบอลฟรี และคลิปไฮไลท์ที่จัดมาแบบเน้นคุณภาพ ครบสุดในเว็บเดียวจริงๆ

ไม่มีอะไรจะดีไปกว่าการได้นั่ง ดูบอลออนไลน์ แบบชัดๆ ไม่กระตุก และไม่มีค่าใช้จ่าย “ดูบอลดูหนัง.com” คือคำตอบสำหรับแฟนบอลยุคใหม่ ลิงก์ดูสดครบทุกคู่ ไฮไลท์ทุกนัด ทีเด็ดทุกวัน อัปเดตไวสุดๆ พร้อมรองรับทุกอุปกรณ์ทั้งคอมและมือถือ อยู่ที่ไหนก็ดูได้

บัลลงดอร์ 2025 ไม่ใช่แค่รางวัลสำหรับคนที่ยิงเยอะหรือแอสซิสต์มากที่สุด แต่คือเรื่องของ “จังหวะชีวิต” ใครที่พีคถูกเวลาจะได้เปรียบทันที เช่น ราฟินญ่าที่ระเบิดฟอร์มช่วงสำคัญของฤดูกาล หรือวินิซิอุสที่โชว์คลาสเหนือชั้นในรอบลึกของ UCL สิ่งเหล่านี้มีผลต่อคะแนนโหวตมหาศาล และอาจทำให้ปี 2025 เป็นปีที่เราพูดถึงการ “เฉิดฉายถูกจังหวะ” มากที่สุดในประวัติศาสตร์รางวัลนี้

เว็บตรงทำเงินง่าย พาทุกคนเข้ามาร่วมสนุกกับ เว็บสล็อตเว็บตรง ได้อย่างสะดวก พร้อมแจกตารางเล่นสล็อตสุดจริงใจ ลงเดิมพันง่ายกว่าเดิม

Adorei cada detalhe desse post! Excelente trabalho de comunicação! Isso é que é um conteúdo transformador! Muito bacana o seu post! Que conteúdo excepcional! 🙏🏾 https://kurier.today/

Недавно нашел на gizbo casino официальный зеркало,

и захотел поделиться своим впечатлением.

Платформа кажется очень интересной,

особенно если хочешь найти качественное казино.

Кто реально пробовал Gizbo Casino?

Поделитесь своим мнением!

Особенно интересно узнать про промокоды и фриспины.

Допустим, предлагают ли Gizbo Casino особые условия для новых пользователей?

Еще интересует, как найти рабочее зеркало Gizbo Casino, если основной портал недоступен.

Читал много противоречивых мнений, но интересно узнать реальные советы.

Допустим, где эффективнее активировать промокоды на Gizbo Casino?

Расскажите своим мнением!

มือใหม่กลายเป็นเซียนได้อย่างง่ายดาย ด้วยการใช้ สูตรคํานวณหวย 2 ตัวล่างแม่นๆ ในแบบฉบับของคุณเอง สามารถคำนวณหวยได้อย่างแม่นยำกว่าเดิม

Betzula guncel giris, spor bahisleri konusunda essiz deneyimler sunar. en heyecanl? maclar icin en h?zl? sekilde canl? bahis oynamaya baslayabilirsiniz.

Betzula’n?n guvenilir altyap?s?, kullan?c?lar?na her zaman kolayl?k saglar. Bet Zula sosyal medya hesaplar?yla ozel promosyonlardan haberdar olabilirsiniz.

Turkiye Super Lig derbilerinin heyecan?n? Betzula ile yasayabilirsiniz.

Ayr?ca, bet zula giris linki, kesintisiz bahis deneyimi sunar. Ozel olarak, https://apsistek.com/ – betzula twitter, profesyonel bir deneyim saglar.

Betzula, spor bahislerinden canl? casino oyunlar?na kadar tum kullan?c?lar?n ihtiyaclar?n? kars?lar. Fenerbahce Galatasaray derbisi icin bahis yapmak icin simdi giris yap?n!

707707+

Betzula, canl? bahis konusunda essiz deneyimler sunar. en heyecanl? maclar icin en h?zl? sekilde kazanma sans?n?z? art?rabilirsiniz.

Betzula’n?n yuksek guvenlik onlemleri, profesyonel hizmet garantisi verir. guncel duyurular? kac?rmadan ozel promosyonlardan haberdar olabilirsiniz.

favori futbol kuluplerinizin heyecan?n? Betzula ile yasayabilirsiniz.

Ayr?ca, Betzula guncel giris adresi, kesintisiz bahis deneyimi sunar. Ozel olarak, bet zula giris, kolay ve h?zl? giris imkan?.

Betzula, mobil uyumlu ve h?zl? erisim f?rsatlar?na kadar tum kullan?c?lar?n ihtiyaclar?n? kars?lar. Fenerbahce Galatasaray derbisi icin bahis yapmak icin simdi giris yap?n!

371212+

All and all, Mike was in all probability the second finest character for me. Remember, the CiC was W, a man who routinely lied to seize energy, hid and faked proof for wars, and scapegoated each little incompetency, and also you expect this character to have respected worldwide treaties or human lives? The doppelgänger then begins communicating with the viewer, who is wearing a helmet and headset. Then the place do we slot in BDSM? If an atheist message isn’t okay, then the ZOMG! I’ve nver been pulled over for DWA (Driving while Atheist) but I know a number of guys here at work which were pulled over for DWB (Drivng while Black). When Kelly was first accused of intercourse crimes over a decade in the past, Boosie stated that he should’ve simply burned the sex tapes. Sex offenders have dedicated heinous acts and so they shouldn’t be allowed into parks or beaches. No atheistic bus-ads right here within the Netherlands, as religious bus-adverts are not allowed.

Transgender people are sometimes called transsexual in the event that they desire medical assistance to transition from one intercourse to a different. He had commissioned Lorenzo to provide her liberally with money: But Elvira, unwilling to obtain obligations from that Nobleman, had assured him that She wanted no rapid pecuniary assistance. Jacintha opened the door of the haunted room with a trembling hand: She ventured to peep in; But the wealth of India would not have tempted her to cross the threshold. As I reached the door of that of Agnes, I ventured to look in the direction of the mattress, on which lay her lifeless body, once so lovely and so sweet! Here I lay snug behind the curtain, till your Reverence found me out, and seized me ere I had time to regain the Closet door. 2008 analysis discovered that, for grades 2 to 11, there were no significant gender variations in math skills amongst the final population. The plumage of the peacock will increase its vulnerability to predators as a result of it is a hindrance in flight, and it renders the bird conspicuous typically. The incensed Populace, confounding the innocent with the responsible, had resolved to sacrifice all of the Nuns of that order to their rage, and never to leave one stone of the building upon another.

In a GDC talk known as Sexy Microtalks: Making Intimacy Romance, and Sex in Games (additionally that includes Robert Yang), narrative designer Michelle Clough explains the facility of narrative and language in video games. Kash introduced his PS2 and Elwing introduced a number of DDR games and her pads. Northern Ireland not too long ago grew to become the first part of the UK to make shopping for intercourse a crime, following legislation brought before Stormont by the Democratic Unionist Party peer, Lord Morrow. One year later, the company faced a category action lawsuit brought by several thousand former staff and job candidates, who alleged the corporate had discriminated against African Americans, Latinos and Asian Americans in its hiring and advertising. It’s already known that they will agree to hold common military exercises, arrange a new three-manner disaster hotline and, crucially, pledge to satisfy once a 12 months. The invoice that authorizes navy tribunals for enemy combatants passed. The invoice will now go to King Maha Vajiralongkorn for royal endorsement, with campaigners hoping the first same-intercourse weddings will take place in October. Gone have been the days that made me so proud about this place. Japan’s Chief Cabinet Secretary Yoshihide Suga made a similar assertion on Monday, however indicated that Japan would still reconsider the historical info on which the statement was made.

She was normally into her individual point, and I like that. I wished to get away from that, and also get absent from the fiction films like Matewan, Coal Miner’s Daughter, and October Sky that exhibit a nostalgic search at the coal city days of yore. Suddenly Doris appears considerably less like a campy icon of the Ed Wood selection and additional like a singular drive who’s loyalty to her possess muse remaining her stranded on the sidelines. It’s packed with adult information and all set to go well with you with a lot more than sufficient groups. She was way much more refined than any individual in her significant school and she always dated older men. It’s all right here, best porn from Young Sex Parties, TS Seduction, Hardcore Gangbang and extra porn organizations. Lieutenant Douglas Fairbanks grinned from ear to ear although soothing at the Stork Club in 1942 with his wife, Mary Lee Epling, and actor Roland Young. Stork Club operator Sherman Billingsley insisted that all of the attendees have an orderly perform whilst in the location. 7/3/22 New litters have arrived! 03/15 New litters posted!

Like every religion, the acts of some folks do not necessarily mirror the beliefs and the behavior of the majority. Many Max Erection Pills do fuel stations sell viagra folks know that the Pope died and was killed by the Demon God Sect. Male enhancement pills contain pure aphrodisiacs – substances that have an effect on the libido and the ability to have a passable intercourse. How Can Male Enhancement Pills Help? Women have special enhancers right now that can positively help them overcome not having that sexual want. You will see Provestra by going right here at present. As long as you get treated in time, you’ll be properly cured and you still have an opportunity to be a mother. If the girl is between the ages of 40 and 60, it may nicely be a lack of curiosity on account of menopause and the ups and downs of mood swings. A effectively carved table Provestra can address both emotional and physical problems with sexual life and leads to greater stage and trust which in turn present larger satisfaction kind intercourse.

The votes in favor of the monthly bill improved at this discussion to a hundred and fifty five (with tellers and pairs 172), a greater quantity than had ever right before been received, though the opposition remained stationary. I now think that there may well be no extra assorted a dish than a bowl of goddamn chili.” –Chuck Wendig “I am all in favor of Zombie Reagan obtaining elected in 2012. I have rituals to take care of this.” –Hasufin “If you inform us not to be robots, you get final results! 4chan’s most notorious autist, “Barneyfag” is the nickname of just one Lee Goldson (“Lee” for brief), who has taken up the mantle of rallying against the brony menace ever considering the fact that 2012 – by which level the ponyfags won the 2011 civil war and received /mlp/ as a containment board all to their very own. Two, Barneyfag will appear and spam the exact couple images and catchphrases over and about again, often up to two dozen posts, until moderators clean up his shitposts and ban him – generally futilely, as Lee utilizes a wide range of IP addresses which will make completely banning him difficult. 4chan is divided into unique boards on the foundation of topics, and subject areas which never match a unique board will be deleted, sent to /trash/, or moved to an on-subject board – which hardly ever transpires due to the fact the moderators are lazy faggots.

Top site lists are usually not static; they evolve over time to adapt to modifications in consumer preferences, technological advancements, and emerging tendencies. Those of you who’ve been in this place before are already shivering. Wow.. are there solely three days left in 2006? Lyssa and I have been back in DC for about two days now, and it has been a hell of a vacation to this point. They embrace the Centennial Park Group (Arizona), the Davis County Cooperative Society (Utah), the Church of the Firstborn (Mexico), the Bountiful Groups (Canada), the Confederate Nations of Israel (Utah), the True and Living Church of Jesus Christ of Saints of the Last Days (Utah), and the Missouri Community (Mormons settled in Missouri after Joseph Smith revealed the Second Coming would take place there). There are dozens of gorgeous places to take your marriage ceremony portraits right here: the out of doors terrace with the charming Inn in the background, the gorgeous banquet hall, and of course the elegantly landscaped grounds, full of garden nooks the place you possibly can cover away. I don’t know if that is actual or not, however I’ve checked out it and the faces are per what I’ve seen within the BBC and CNN information morgues, so I’m willing to suspend judgement of this video, which seems to show the last few seconds of Hussein’s life.

Well, my journey to the dentist was eventful and, on the entire, not almost as unhealthy as it might have been. You need to love greenback shops generally. The bizarre thing is, the shops aren’t significantly packed. One factor concerning the professor, he’s obtained a sense of humour, but it’s subtle. Researchers rubbed one forearm of each child with a poison-ivy leaf however advised them the leaf was harmless. This requires not solely a four-foot height from the flooring but a a lot smaller tree than we used to make use of (this one is simply about 4 feet in top in itself and is actually made from a very dense mass of optical fibre with a multicoloured mild in the rotatig base). Too much time studying and never enough time playing with her, I believe. There isn’t much there but I’ll let everyone know what’s what as soon as I get it all performed. It’ll also let you sign the message, encrypt it to the opposite person (I don’t know if it will encrypt to a number of folks yet, although, or no less than I do not know the best way to do it but), or do each.

Writing, power, and technology are old companions in Western tales of the origin of civilization, but miniaturization has modified our experience of mechanism. Primal play: This kink centers on partners getting in contact with their baser, animal instincts. One in all my premises is that almost all American socialists and feminists see deepened dualisms of mind and body, animal and machine, idealism and materialism within the social practices, symbolic formulation-tions, and bodily artefacts related to ‘excessive technology’ and scientific culture. Another of my premises is that the need for unity of individuals trying to resist world-wide intensification of domination has never been extra acute. However the constructed revolutionary subject must give late-twentieth century individuals pause as nicely. It stays to be seen whether all ‘epistemologies’ as Western political individuals have known them fail us in the duty to build effective affinities. As orientalism is deconstructed politically and semiotically, the identities of the occident destabilize, together with these of feminists.9 Sandoval argues that ‘girls of color’ have a chance to build an effective unity that does not replicate the imperializing, totalizing revolutionary subjects of previous Marxisms and feminisms which had not confronted the results of the disorderly polyphony emerging from decolonization. White girls, together with socialist feminists, discovered (that is, had been pressured kicking and screaming to note) the non-innocence of the class ‘woman’.

In 2023, Mitini Nepal, an LGBT advocacy group, filed a lawsuit challenging the constitutionality of the definition of marriage within the Nepalese Civil Code. On 13 July 2023, the Kathmandu District Court rejected a marriage registration software filed by a Nepalese couple, Maya Gurung, and Surendra Pandey, regardless of the court order. Another transgender couple, Sampurna Adhikari and Heema Gurung, have been married on 2 October 2024 in Devachuli, Nawalpur District. 6 October 2024 in Dharan, Sunsari District. After marrying in Germany in October 2018, the couple moved to Nepal, and attempted to have their marriage acknowledged by immigration authorities. So I must reject the notion that a perception is any more valid as a result of folks – even great people – draw their inspiration from it. Sometimes it can even be both. It surprises me that no-one has but recognized that Eagletosh was uttering prophecy, not speaking about events which might be skilled in the “now”. So, is Eagletosh in any respect related to Ditchkins? The National Code of Nepal, enacted in August 2018, explicitly defines marriage as “when a man and a woman accept each other as husband and wife”. The National Code of Nepal enacted in 2018 explicitly defines marriage as “when a man and a woman settle for each other as husband and spouse”.

“There’s one thing wicked about sleeping with someone new,” he says. He says that he has felt no guilt during all the moments, harsh and tender, of his marriage. “It was time. All my associates have been getting married.” They moved to a house within the suburbs, his spouse quit her job to have a couple of kids, and over time the homes received bigger and the marriage shrank. ” I responded, completely over the bougie birthday bash and hoping to make some cold laborious cash. It’s gotten larger and greater over the years; it’s the extra fascinating place to be. “I think it’s been good for me in quite a bit of ways. It’s not all that hard to see why women sleep with him. He informed the first girl that he had by no means performed such a factor earlier than they usually must never see one another once more. But the following day, there was one other woman at lunch, prettier, smarter, and equally obtainable, and “now I’ve this dilemma because I need to get rid of the one from the night before. And there was a lot to get away with back then, so many ladies for whom the glint of gentle in a stranger’s eyes shone rather more brightly than his wedding ring.

Sexual taboos are sure sexual acts that are thought of to be exterior of the norm. Fresh videos are waiting around for you on the website page named Latest. The most current nineteenth News/SurveyMonkey poll exhibits that an escalating amount of Americans say democracy and the economic system are working properly for them. I would say this though, of class, because I’m a single of these militant humanists who thinks that compassion concerning precise, living people is extra critical than the reported contemplative vicissitudes of an unverified deity. Sexual intercourse involving many ladies in which a person person is the central aim is acknowledged as reverse gangbang. A human analyst in a central control space will make the ultimate contact as to no matter if to dispatch law enforcement to the scene. A area citizens’ human rights group that assisted Mr Das to file the petitions feels that the law enforcement are below political force to undercount scenarios of rapes. Their mama stated “You Can’t Hurry Love” but can you explain to who they are? Western New York state resident Norman Fleck, who has counted himself amongst the followers of Crowley’s teachings for a long time. I by no means realized but a person Indian who worked. The tallest Indian of them all, Long Soldier, grew to be pretty crafty when he uncovered what a curiosity he was.

It’s just that someplace together his movie producing journey he seems to have gotten completely and totally missing. These “nudity riders” are published contracts typically applied by film and television exhibits that intend to film intercourse or nude scenes. While some anti-porn feminists propose connections in between consensual BDSM scenes and rape and sexual assault, sexual intercourse-favourable feminists uncover this to be insulting to women. The Finnish black comedy film Dogs Don’t Wear Pants (2019) provides the viewer with a dive into the dark-toned planet of BDSM. National Society of Film Critics. Adolescents who check out and listen to a whole lot of media are a lot more most likely than much less standard audiences to look at stereotypes of sex roles on Tv as sensible. One large egg incorporates 212 mg of cholesterol, which is a Lot as opposed to most other foodstuff. A significant egg is made up of 77 energy, with six grams of good quality protein, five grams of fats and trace amounts of carbs. 1. Whole Eggs Are Among The Most Nutritious Foods on Earth One total egg incorporates an awesome variety of vitamins and minerals. In a person examine, thirty over weight or obese women eaten possibly a breakfast of eggs or a breakfast of bagels.

If you’re involved that you might have been uncovered to a sexually transmitted infection (STI) or HIV, e-book an appointment with a physician or sexual health clinic. Remember that you simply only need to have oral or penetrative sex with somebody once to contract an STI. Keep a watch in your genitals, anus, and mouth area, and schedule an STI take a look at in case you notice something unusual. Remember, start conversations early and keep talking. What you do want to remember, though, is that there are a number of risks associated with these sexual occasions. But there are plenty of steps you may take to address those dangers so that you simply stay protected and sexually wholesome. Try to talk to friends or family about the situation so that they will support you. Seek medical care if crucial, and attain out to the National Sexual Assault Hotline or Loveisrespect for assist and steerage on what to do next. You’ll be too busy ensuring that you’re holding your rhythm in verify and balanced enough to carry her up and support your self that the last thing your body shall be occupied with is how nice the intercourse is.

Q: I’ve had therapy previously for three years for consuming disorder issues and self hurt. The West Memphis Three cases are maybe probably the most well-known to come back out of the satanic panic witch hunts. Will be needing a new Doctor are you able to suggest one in West Auckland. I’m starting to doubt if I ever will recuperate from these items? 1001 enjoyable issues to do with liquid nitrogen! There are reams of paperwork pertaining to what’s occurring but they’re going to in all probability by no means be launched to the general public because they carefully documented every screwup and change of plans which have hamstrung issues to at the present time. There’s a chance of mild pores and skin irritation, but otherwise there aren’t any uncomfortable side effects. All strategies use both the prevailing hair or the pores and skin as anchor websites. On this 20-yr-old process, a much larger portion of hair-bearing skin — principally a flap — is transferred from the sides or again of the head to the balding area.

More than any other, this is the online video that built Prince a star. I’ve made use of that movie in course with my pupils. My character – the very same character I’ve been playing on and off considering the fact that November – was just a little bit a lot more effective than he was ahead of. Someone could possibly detect, but the close final result is the identical. If you soar ship much too swift, you may conclude up shelling out for one thing you won’t use or is lacking that just one tiny feature you did not know you needed. Getting people on track ordinarily starts off good: use a distinctive browser you say? I say there is not, nor can there be, any God but existence alone. For info on what the Internet has to supply, the homosexual porn evaluations will introduce you to all the things you require to know about the very best web-sites out there. We need to have to change the script, and emphasis on assisting the young era come across the instruments that reflect their values and teach them that their private information warrants respect.

The sentiments which encouraged this hostile frame of mind to the analyze of the sexual existence are still active, however developing steadily considerably less popular. Gem′iny (Shak.), twins, a pair: utilized as a mild oath or interjection, from the typical Latin oath O Gemini, or simply Gemini-spelt also geminy, gemony, jiminy. It carried them securely for awhile right until they grew eager for extra passengers, and so took on board all fashion of rats that had operate absent from all types of spots-Irish rats and German rats, and French rats, and even black rats and soiled sewer rats. Everything you locate here is one particular hundred % legal and a single hundred per cent over board. The symptoms of the purposeful psychoneuroses characterize, following a style, some of these distorted attempts to locate a substitute for the essential cravings born of the sexual instincts, and their type typically depends, in aspect at least, on the peculiarities of the sexual existence in infancy and early childhood. Every species of forgetfulness, even the forgetfulness of childhood’s decades, was built to generate its hidden stores of knowledge desires, even even though seemingly absurd, were being located to be interpreters of a different course of feelings, active, even though repressed as out of harmony with the selected daily life of consciousness layer immediately after layer, new sets of motives underlying motives were being laid bare, and every patient’s fascination was strongly enlisted in the undertaking of finding out to know himself in order more really and sensibly to “sublimate” himself.

He was taken to a few individual residences, and was supplied several amnesties, together with a radio to listen to the race. Several people today, together with Paroubek’s father and the law enforcement in demand of the investigation, suspected Roma (who experienced numerous camps in the place at the time) ended up associated. Some time afterwards he became an evangelist. Walter was despatched to a fireworks store, during which time the men left with his brother. That night time, Corbett mistakenly thought he was currently being watched by the Federal Bureau of Investigation, and still left Denver the subsequent early morning. After consuming the equal of three bottles of beer, I wanted to rest off the relaxation of the night time, that I could shut the people out of my head ultimately. How do you communicate to your teen about sexual intercourse without having freaking them out? It could be various tactics, locations, positions, function performs, products and solutions (diverse designs of condoms, lube, sexual intercourse toys), and many others. In other phrases, as long as you grasp productive sexual intercourse capabilities, you will effortlessly get great sex. Are you intending to get a extended-time period romantic relationship with your partner? Group intercourse has been depicted in artwork and literature for generations, and some of those people portrayals are celebratory. Vietnam War and made use of for intercourse just before staying stabbed and shot to loss of life by a person of the soldiers, Steven Cabbot Thomas, in buy to conceal the crime.

Once we achieve this, we query the benevolence and providence of the logos, and thereby degrade our own logos. Not showing off your obedience to the logos, but resting in it. I will not go into the details because they’re really not vital, and I don’t need to prod anybody out there in any tender places. Of Socrates’ predecessors (the so-known as pre-Socratic thinkers), a very powerful, both for Marcus and the Stoics typically, was Heraclitus, the mysterious determine from Ephesus (in modern-day Turkey) whose Zen-like aphorisms were proverbial for their profundity and obscurity alike. Though Heraclitus was clearly the pre-Socratic who most influenced Marcus, different thinkers depart traces as well. Marcus refers to Diogenes in several passages, in addition to to the latter’s student Monimus (2.15), and invokes one other Cynic, Crates, at Meditations 6.13, in an anecdote whose tenor is now unsure. The late Stoicism of Epictetus is a radically stripped-down model of its Hellenistic predecessor, a philosophy which “had learnt a lot from its rivals and had virtually forgotten parts of itself.”3 Both these tendencies, the narrowing of the sphere and the eclectic borrowing from non-Stoic sources, could be discerned additionally in the Meditations.

1.2 % of the human genome consists of protein-coding genes. This consists of the protein-coding genes, but additionally genes that code for RNA which isn’t translated into proteins – tRNA, rRNA, and a protracted listing of regulatory RNAs. No. If we had no junk DNA at all, most mutations would nonetheless be harmless, because they wouldn’t change the amino acids genes code for, and because regulatory parts hardly ever have precise sequence requirements. I’ve already mentioned Takifugu rubripes: 1/eight of our genome size, yet at least as many genes as we have. The Wikipedia quote you give talks about 2.Eight % of the human genome. Give your common intercourse toys a break: Vibrators and dildos are loads of fun, but they’re not the only intercourse toys in town. In case your guilt is preventing you from having sex with younger girls, these tiny sex dolls are the answer to your erotic wishes!

Griselda then comes upon a phone intercourse hot line and her world adjustments perpetually, as she finds herself addicted to the debaucherous life style. 7. The company provides you with the Company’s telephone numbers and customer service data. Within the United Kingdom, the Network for Sex Work Projects (NSWP) was based in the 1990s. Based in London, United Kingdom, the organization serves as an data exchange for 40 initiatives and operations internationally. In porn, there are few situations the place the man is depressed so he cannot get it up, or the girl is pissed off and does not want to have intercourse. In an interview with TechCrunch, Spiegel described struggling with sex dysfunction because of an eating disorder and her perception that porn adds to physique image pressure. Babblers sleep together lined up alongside a single department, and the 2 exposed ends of the line are the most dangerous, the most susceptible to predators. This competition is fiercest between babblers of adjoining rank. And instantly the intense competitors is smart. Competition here means that babblers will sometimes attempt to stop others from feeding the infants. Again, larger-ranked babblers compete to do greater than their “justifiable share” of those defensive actions.

Get some low-cost accessories to make shower sex all the higher. Roughly 70 percent of women need extra clitoral stimulation to orgasm throughout penetrative intercourse, so get handsy. It will even experience more rejuvenated and capable of take on your day. Take a while to jot down down any adjustments you’ve seen to date throughout this challenge, even when they’re miniscule. If you’ve got a date later that night, try sending a number of flirty or suggestive texts your partner’s manner to ensure they’re fascinated about you all day. Summer is often the time when there are few grant deadlines or proposal deadlines for conferences. Particularly, cryptorchidism patients can understand the event of testicles and whether they are swollen or malignant. Refrain from jumping their bones at first sight like you usually do, and let the sexual tension build up so you’ll be able to have an even more cathartic orgasm. The immediacy of maintaining clothes on is sizzling-such as you cannot wait to have one another. But different lists have totally different criteria for what constitutes a very good receipt: my FediNuke, my tier-0, and TBS all have completely different criter… One person goes to town, whereas the opposite groans and moans about how good it feels, you then switch.

We want to phone it an unrequested fission surplus.” –Mr. Burns “The arena language is an remarkable scripting language based on ANSI-C, but extended to have some object-oriented methods and a very intelligent indigenous-language contacting interface which needs no further glue in get to connect with capabilities in 3rd-get together libraries – the capabilities can be referred to as straight from the arena script. They may possibly not be the superstars of porn, but these attractive chicks get off on making home made video clips where by they can tempt you with their restricted, nimble bodies and proficient tongues. You could get the crucial areas from the ultimate Programme section, then the “what not to do” chapter closing sheets. They say interaction is crucial in a romantic relationship. AT “I as soon as study that the procedures of making credit rating make a good deal additional perception if seen as ‘How successful are you to mortgage funds to?’ as opposed to ‘How trusted are you?'” –@emptysetgo “I failed to realise so numerous persons would believe this is a lie. Fine, be cynical. This transpired, I was speechless in the minute, did what I did and that is it. I’m sorry I shared, but thank you to all the persons that appreciated this, it can be a special second for me.” –Ben James “I have a feeling in 20 many years the biggest result of covid will have been its effect on antibiotic and antifungal resistances, as billions of people today in nations denied vaccine obtain are uncovered to nosocomial infections in overwhelmed hospitals. Imagine it is the yr 2030 and organ transplants are only no more time doable because of to a lack of any successful antibiotic/antifungal drugs to treat unavoidable nosocomial infections. Suddenly, prognosis for renal failure returns to what it was in the 1960’s.” –Pookleblinky “The legibility grooves in culture are self-sporting.” –Robin Tarsiger “I sense the want to keep on wearing my mask exterior even nevertheless I’m thoroughly vaccinated mainly because the inconvenience of possessing to dress in a mask is much more than worth it to have folks not think I’m a conservative.” –David Hogg “In a parallel dimension I’m Emperor Norton and have an 18 inch dick. And so do you.” –Richard Metzger “Never, by the way, be fearful of getting incorrect. Being incorrect just signifies the world is additional interesting than you thought it was.” –Dan Kaminsky “The FBI loves the X-Files mainly because it helps make individuals associate authorities coverups with wacky shit like Roswell as a substitute of precise atrocities like COINTELPRO.” –Technomancy “Nearly all the things that matters is a aspect influence.” –Maradydd “The greatest tragedy of this transforming culture is that individuals who never ever realized what it was like prior to will merely believe that this is the way factors are meant to be.” –2600 Magazine, Fall 2002 “Politics is like driving. D to go forward, R to go backwards.” –Phil Shapiro “Drink TAB. It’s just like the fucking Andromeda Strain!” –Rev.

A member of the campus local community who fails to withdraw from participation in choices that may possibly reward or penalize the social gathering with whom he or she has or has experienced a sexual or passionate marriage will be deemed to have violated his or her moral obligation to the University. And on leading of this chaos Mr. Ramsay bought up, pressed her hand, and said: “You will discover us considerably changed” and none of them had moved or had spoken but had sat there as if they had been pressured to enable him say it. At the same time, she seemed to be sitting down beside Mrs. Ramsay on the beach front. According to The Daily Dot’s Ana Valens, the website’s conditions and situations held the end users who uploaded content, not the house owners, dependable for copyright concerns. Likewise in phrases of narratives the critical information are unfortunately always all those that middle about hurt, like wherever it is coming from, how to avert it, how it was averted or how it couldn’t be averted. In the Usa countercultures also exist that are a lot more European oriented, specifically in California (the Esalen massage heart) and masseurs performing in the major towns of the East Coast. The associates of the momentary partners ended up sexually captivated to every other additional than to any individual else, but in all other respects their interactions experienced not demonstrated the attributes of intimate really like.

Srivastava, Aatish (December 1, 2011). “Sunny Leone in ‘Bigg Boss’: BJP youth wing president seeks motion towards Colors : Gossip News – India Today”. The Civil Partnerships Act 2011 allowed for identical-intercourse couples who’re Queensland residents to enter right into a civil partnership. Those who’re forty and older are most likely to have complications. Although it might sound foolish on the surface, infants at this stage are greater than capable of listening to outdoors voices, which they might even recognize quickly after supply. Others might favor a unique term, akin to non-binary, genderfluid, male, or female. Themes from the Independence Movement deeply influenced Bombay movie directors, display screen-play writers, and lyricists, who saw their movies in the context of social reform and the issues of the frequent folks. The nineteen thirties and 1940s had been tumultuous times; India was buffeted by the great Depression, World War II, the Indian independence movement, and the violence of the Partition. By the nineteen thirties, the Indian film trade as an entire was producing over 200 films per 12 months. Alongside business masala movies, a particular genre of art films known as parallel cinema has also existed, presenting practical content material and avoidance of musical numbers. The preferred commercial style in Hindi cinema because the 1970s has been the masala film, which freely mixes different genres together with motion, comedy, romance, drama and melodrama together with musical numbers.